While otters see a fire-damaged house as a total loss, an experienced professional sees a huge potential.

The very smoke and soot that deter traditional buyers are also signs of a distress opportunity with massive profit potential.

This is a unique landscape where you can turn a damaged property’s liability into your greatest asset.

But, the real trick is correctly evaluating the home’s worth and how much ROI it can generate for you.

Let’s take a look at the top factors that signal go green on a fire damaged property investment vs a no-go.

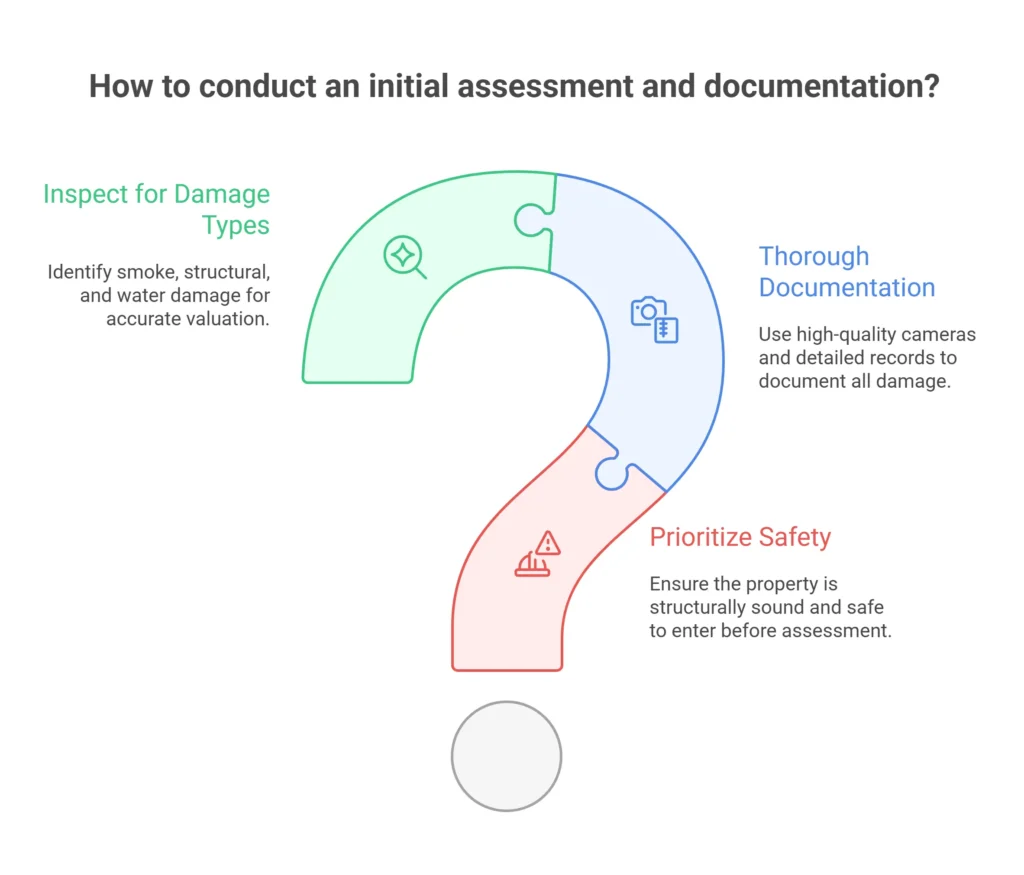

The Foundation: Initial Assessment and Documentation

Before you can even begin to think about numbers, you must conduct a thorough and systematic on-site assessment. The foundation of an accurate valuation isn’t a guess—it’s a meticulous inspection and a complete set of records.

Prioritizing Safety and Thorough Documentation

Your first priority is safety. Always ensure the property is structurally sound and safe to enter before starting your assessment. Once safe, document everything. Use a high-quality camera to take detailed photos and videos of all visible damage.

Don’t just focus on the obvious charred areas; look for subtle signs of heat stress, structural issues, and especially smoke and soot damage.

Create a room-by-room inventory of damaged belongings and note their pre-fire condition and value. This information is vital for helping a seller with insurance claims and for giving investors a clear picture of the property’s state.

Finally, gather all essential documentation, including the property deed, any existing insurance policies, pre-fire inspection reports, and records of any past renovations.

On-Site Inspection: What to Look For

The damage from a fire is rarely confined to a single area. A comprehensive inspection requires you to look for three distinct types of damage:

Smoke and Soot

Restoration smoke damage is often the most pervasive issue. Smoke residue and the acrid odor can penetrate walls, ceilings, HVAC systems, and even personal belongings. This type of damage requires specialized cleaning and odor removal techniques.

Structural and Heat Damage

This is the most critical type of damage to identify. Look for signs of structural compromise, such as warped wooden beams, sagged ceilings, or a compromised roof truss. Distinguishing between cosmetic charring and a weakened structure is essential for an accurate cost estimate.

Water Damage from Firefighting Efforts

The water used to extinguish the fire can often cause as much, if not more, damage than the fire itself. Inspect for water lines, water-logged drywall, and the potential for mold growth in damp areas.

The Role of Professional Expertise in Valuation

You, as a Realtor, are the project manager, but you are not the only expert needed. Accurate valuation depends on a team of professionals.

Hiring a Qualified Appraiser

Seek out an appraiser with specific experience in fire damage assessment. A standard appraisal won’t suffice. You need someone who understands how fire damage repair and restoration impact a property’s value, who is knowledgeable about local building codes, and who can factor in the unique market conditions for these distressed properties.

Consulting with Contractors and Engineers

A key part of your valuation process is to obtain detailed repair cost estimates. This step is non-negotiable. Engage at least three licensed fire damage restoration companies to get quotes.

The quotes should be itemized, breaking down the costs for demolition, smoke and soot cleaning, odor removal, and final rebuilding. The fire damage and restoration process is complex, so having multiple estimates helps ensure your numbers are accurate.

Additionally, if there’s any question about the property’s structural integrity, engage a structural engineer. Their inspection of the foundation, walls, and roof is critical for determining the true scope of work and avoiding costly surprises.

Pro Tips:

Pro Tips:

- Meticulous documentation of damage, quotes, and permits is essential for accurate valuation.

- Rely on appraisers, engineers, and fire restoration services for professional, data-driven assessments.

- Use local regulations and market demand to guide your pricing and target the right buyers.

Applying Valuation Methods

Pre-Fire Property Value

Establish the property’s value before the fire using comparable sales data for undamaged homes in the same area. This number is your “After Repair Value” (ARV) and is the foundation of your calculations.

Cost Approach

Estimate the cost to rebuild the home today, accounting for current construction costs, materials, and labor. This can be complex, but is a useful technique when comparable damaged properties aren’t available.

Market Comparison Technique

Analyze sales data of similar properties, both damaged and undamaged, adjusting for the fire damage extent and location. This provides a more realistic view of what the market is willing to pay.

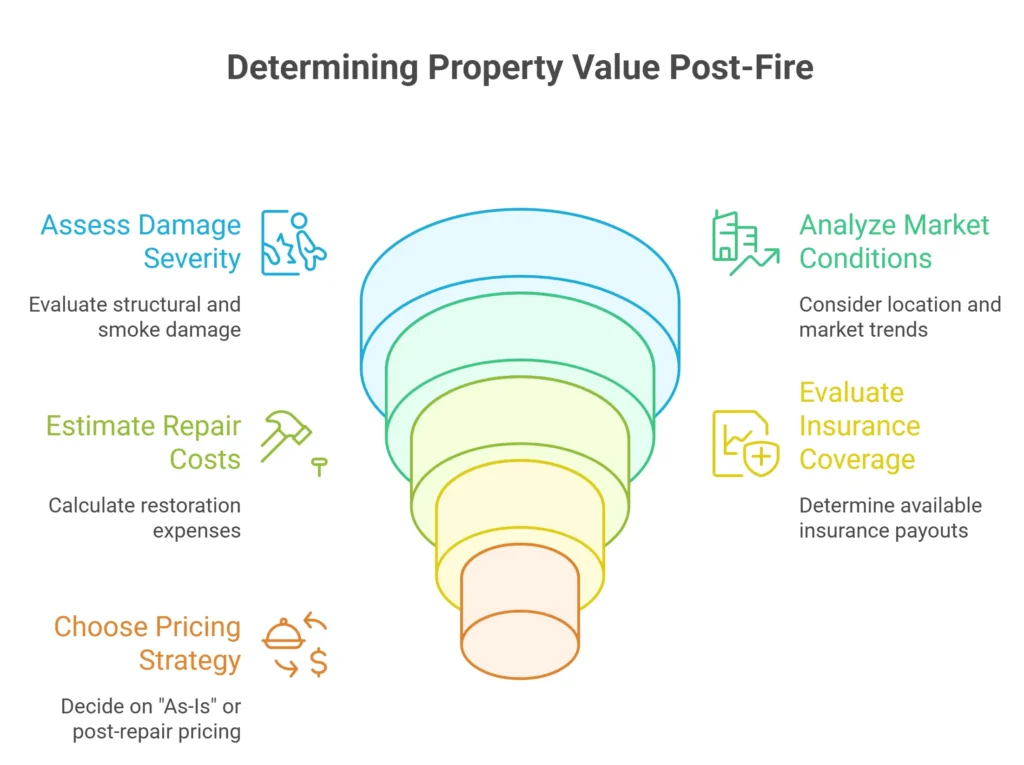

Factoring in Value and Strategic Pricing

Once you have your data, you can move on to the strategic part of the process: pricing.

Key Factors Affecting Post-Fire Value

The final value of the property is a mosaic of several critical factors:

Severity of Damage

The extent of structural damage, smoke penetration, and water damage from firefighting efforts are the most critical considerations.

Location and Market Conditions

Properties in a strong, hot market may retain more value despite the damage. Urban properties often fare better than rural ones.

Repair Costs

The most significant factor in determining the final value is the estimated cost of restoring the property.

Insurance Coverage

The extent of the seller’s insurance coverage and potential payouts directly impacts the funds available for restoration and, therefore, the property’s market value.

The Pricing Strategy

As a Realtor, you have two primary options for selling a fire-damaged home.

Pricing “As-Is”: The Investor’s Opportunity

This strategy is for a seller who doesn’t want to deal with the complexities of restoration. The target buyer is an investor who is willing to take on the fire damage repair work.

The formula for an investor’s offer is typically: After Repair Value (ARV) – Restoration Costs – Holding Costs – Profit Margin = Offer Price. Your role here is to price the home competitively to attract these specific buyers.

Pricing Post-Repair: The Retail Approach

This strategy is for a seller who is willing to manage the fire damage and restoration process. In this case, you would use comparables of fully-restored homes in the area to set a competitive price, appealing to traditional retail buyers.

Your Role: Navigating Disclosures, Marketing, and Client Guidance

Your role extends far beyond valuation. You are the key to guiding a seller through this challenging process.

Full Disclosure

Legally, sellers must disclose all known fire damage, even if repairs have been completed. Transparency is non-negotiable.

Target the Right Buyers

Your marketing should not be aimed at traditional retail buyers. Instead, you should target investors and renovation specialists.

Highlight Potential

Emphasize the property’s location, land value, and potential for renovation to attract the right audience.

FAQs

How long does a typical fire damage restoration project take?

The timeline can vary significantly based on the severity of the fire damage. Minor projects (smoke cleaning) might take a few weeks, while a major rebuild can take several months. A professional fire restoration services quote will provide a more accurate timeline.

Is it better to sell a fire damaged home "as-is" or after repairs?

This depends on the seller's resources and risk tolerance. Selling "as-is" is often faster and requires less capital, targeting investors. Selling after repairs can yield a higher retail price, but requires a significant investment of time and money from the seller.

Can I use the seller's insurance estimate for my valuation?

You should not rely solely on the insurance estimate. It serves as a good starting point, but a professional Realtor's valuation must include independent quotes from contractors and a thorough market analysis to ensure the numbers are realistic for the sale.

What are the most common hidden costs in a fire damaged property?

Hidden costs often include extensive smoke damage remediation in the HVAC system, unexpected structural repairs found after demolition, the need for code upgrades during the rebuild, and the costs of long-term storage for personal belongings.

How do I find an investor interested in a fire damaged property?

Targeting investors requires a specialized approach. You can leverage platforms that provide off-market leads or networks of investors who specifically look for distressed properties. Marketing should focus on the property's potential for profit rather than its current condition.

Conclusion

It’s true that a fire damaged property presents unique challenges.

But, with a systematic and data-driven approach, you can turn it into a massive ROI opportunity.

By mastering the valuation process, you can expertly guide sellers and investors, positioning yourself as a strategic partner in this profitable niche.

Understanding how to assess damage, factor in fire restoration services costs, and set a competitive price allows you to turn a difficult situation into a lucrative venture.

Ready to find these hidden opportunities and master the valuation process? Our specialized data services provide the off-market leads you need to get started. Feel free to reach out to us.