Tired of fighting for the same listings in a competitive market?

What if you could find off-market deals with little to no competition?

A tax delinquent property list is your secret weapon. This isn’t just a list of names and addresses; it’s a strategic tool that can open up a low-competition pipeline of distressed deals, giving you a powerful competitive advantage.

This guide will show you how to leverage this data to grow a predictable, scalable real estate business.

What Exactly Is a Tax Delinquent Sale List?

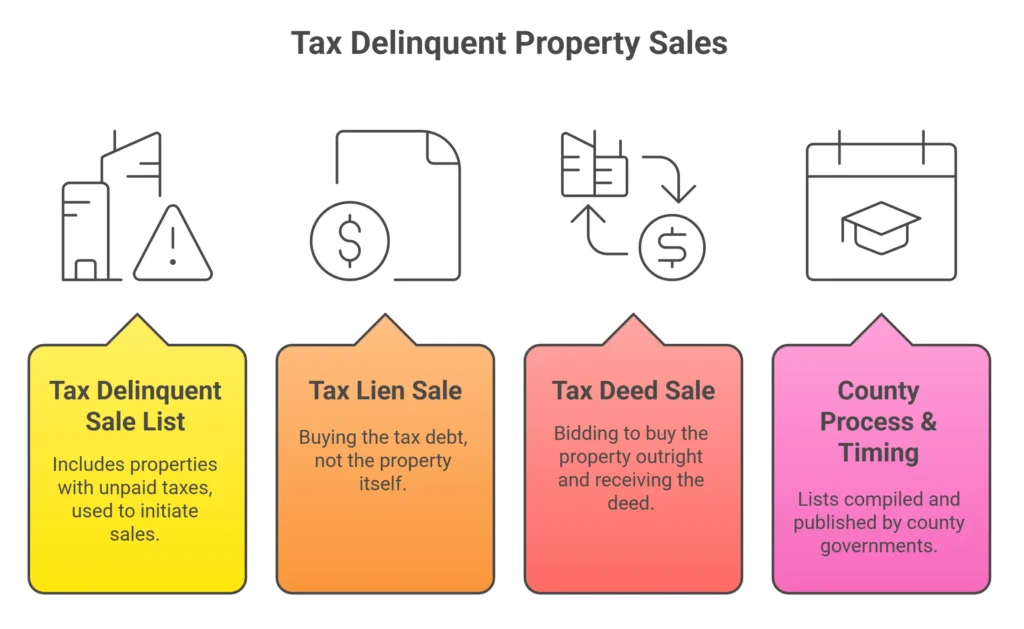

At its core, a delinquent tax sale list is a list of properties on which the owner has failed to pay property taxes for a specified period. When this happens, local government entities—typically the county—have the right to either place a lien on the property or seize it and sell it to collect the back taxes owed.

Tax Lien vs. Tax Deed

It’s crucial to understand the two main types of sales that stem from a tax delinquent property list:

Tax Lien Certificates

In this type of sale, you are purchasing the tax debt, not the property itself. The property owner retains ownership but now owes the back taxes plus interest to you, the lien holder.

If the owner pays the debt (redeems the property) within a set period, you get your initial investment back with a healthy interest return. If they don’t, you may have the right to foreclose on the property.

Tax Deeds

In a tax deed sale, you are bidding for direct ownership of the property. When the county sells a tax deed, the buyer receives a deed to the property and becomes the new owner.

While this seems more straightforward, there are legal complexities to consider, such as quiet title actions.

Counties are responsible for compiling and releasing these lists. The timing of their release varies by jurisdiction, with some publishing them quarterly and others annually.

Where to Get the Most Reliable Lists

Accessing an accurate tax delinquent properties for sale list is the most critical step in this strategy. You have two primary options:

Manual Sourcing

You can get these lists directly from the source. This typically involves visiting a county courthouse, a tax assessor’s office, or the county treasurer’s website.

While this is free, it’s often a labor-intensive and time-consuming process. The lists can be unformatted, incomplete, and require significant work to clean up before they are useful.

Automated Solutions

This is where data platforms and services come in. These solutions aggregate public data from thousands of counties, clean it, and present it in a searchable, filtered format.

Using an automated service allows you to get a reliable delinquent tax sale list early, often before it’s widely available to the public, giving you a significant head start.

Pro Tips:

Pro Tips:

- Partnering with a specialized real estate attorney who is experienced in tax deed law is a small investment that can save you from huge legal and financial risks down the road.

- Don’t underestimate the time value of money. The hours you save on manual data collection can be spent on high-value tasks like lead generation and closing deals.

- The market, laws, and technology are constantly changing; stay current to maintain a competitive edge.

- Building a network of trusted professionals—from contractors and inspectors to lenders and title officers—is crucial for a seamless and scalable workflow.

The Professional’s Playbook: How to Use These Lists (B2B Focus)

A tax delinquent property list can be a versatile tool for any real estate professional. Here’s how different roles can leverage this data:

Agents and Brokers

Use the list to build an exclusive, off-market inventory for your buyers. By approaching delinquent owners before the property hits the auction block, you can secure unique listings and become the go-to expert in your area for distressed properties.

Wholesalers

This is your goldmine. A delinquent tax sale list allows you to create a high-volume deal pipeline. You can quickly filter for properties with strong potential and connect with owners to get a property under contract, which you can then assign to a cash buyer or investor.

Investors and Developers

The list helps you directly identify undervalued properties for flips or long-term rental portfolios. By targeting properties with low tax debts and high market value, you can maximize your potential profit and build a solid portfolio.

Property Managers

You can spot distressed homeowners and offer your services before a tax sale even happens. A delinquent owner is a motivated owner, and by helping them manage their property and avoid foreclosure, you build a valuable, long-term relationship.

Analyzing a Tax Sale List Like a Pro

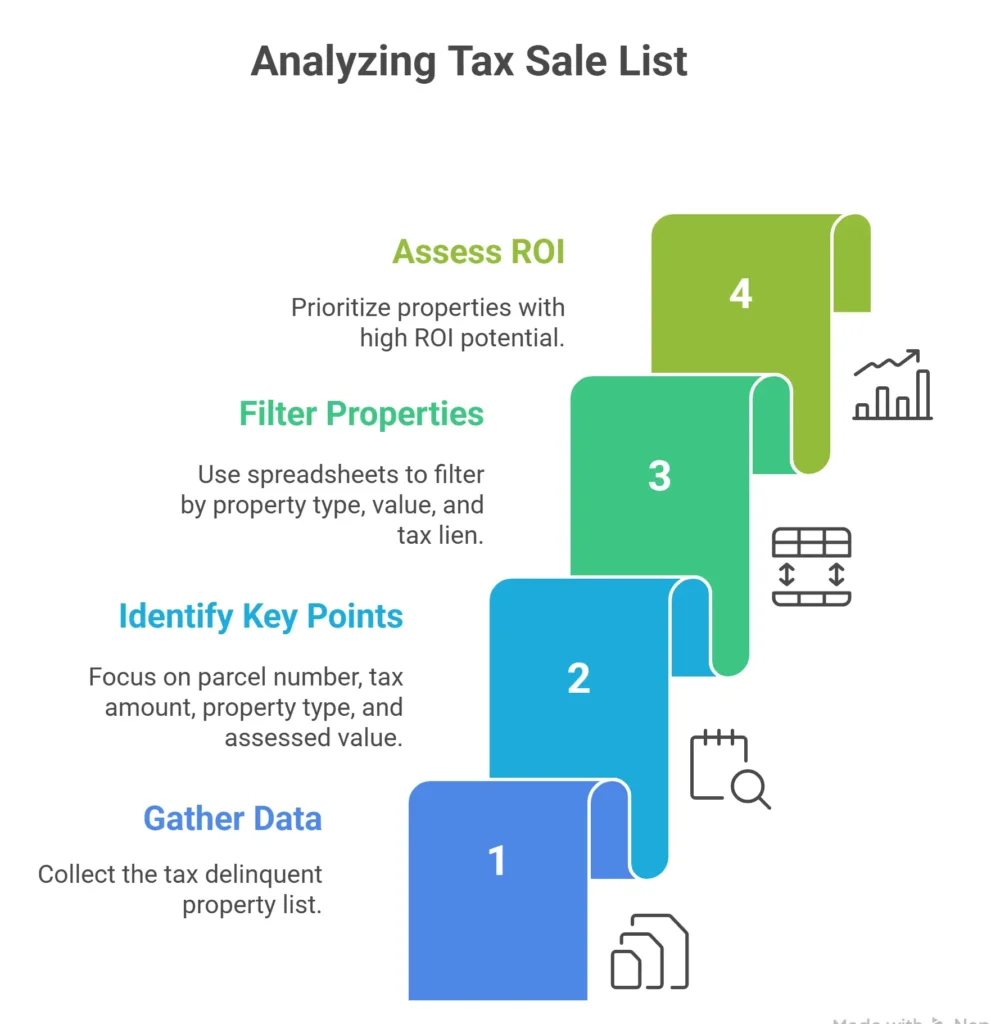

Once you have your tax delinquent property list, you need to analyze it with a professional eye.

The Data Points that Matter

Focus on the critical information. Pay close attention to the parcel number, the total tax amount due, the property type (residential, commercial), and the assessed value. The assessed value, in particular, gives you a baseline for potential ROI.

The Filtering Process

This is where a spreadsheet or a data platform becomes indispensable. Filter by property type, assessed value, and the amount of the tax lien. For example, an investor looking for flips might filter for single-family homes with an assessed value of over and a tax debt of less than $10,000.

ROI Potential

Prioritize properties where the tax debt is a small fraction of the property’s potential value. This is where your deep market knowledge comes into play, as you can quickly spot opportunities that others might miss.

Due Diligence Beyond the List

Never rely solely on a tax delinquent property list. It’s only a starting point. Thorough due diligence is non-negotiable to protect your investment.

Title Checks

The tax list won’t show you all the hidden liens. You must conduct a title search to find other encumbrances like mortgages, IRS liens, or mechanics’ liens. These can prevent you from getting a clean title and turn a good deal into a legal nightmare.

Physical and Virtual Inspections

Use virtual tools like GIS maps and Google Earth to get a sense of the property’s condition and neighborhood. Whenever possible and legally permitted, physically drive by the property to check for visible damage or signs of life.

Legal Clarity

Understand your state’s specific redemption period. This is the amount of time an owner has to pay off their debt and reclaim the property after a tax sale. A title is not considered “clean” until this period has passed.

Acquisition Strategies from the List

Pre-Auction Owner Outreach

This is often the most effective strategy. Approach delinquent owners with empathy and a solution-oriented mindset. You are not just a buyer; you are offering them a way out of their financial stress and helping them avoid a public auction.

Auction Bidding Best Practices

For tax deed sales, set a strict maximum bid based on your due diligence. Do not get caught in a bidding war. Remember, your profit is made when you buy, not when you sell.

Post-Auction Opportunities

Keep an eye on the lists of properties that didn’t sell at auction. These often become available for purchase directly from the county at a reduced price.

Risks Professionals Must Manage

While lucrative, tax sales are not without risk. Be aware of the following:

Legal Hurdles

The quiet title action is a legal process that confirms your ownership and clears the title of all prior claims. This is a necessary step in most states to ensure you can resell the property with clear title insurance.

Financial Risks

Overbidding can quickly erode your profit margins. Similarly, underestimating repair costs can turn a profitable flip into a money pit.

Reputation Risks

When dealing with distressed owners, a compassionate approach is essential. Your reputation is your most valuable asset.

Systematizing Your Success

The true power of this strategy comes from making it a repeatable, scalable system.

Set Up Alerts

Use a platform to get instant alerts for new tax delinquent lists in your target counties.

Establish a Workflow

Create a consistent process for analyzing, filtering, and prioritizing properties on the list.

Build a Team

As your deal flow grows, delegate tasks like initial research, owner outreach, and due diligence to a team or an investor network.

FAQs

Q1: Is buying a tax delinquent property risky?

Yes, it can be if you're not careful. The primary risks are hidden liens and legal issues like redemption rights. However, with proper due diligence and professional guidance, these risks can be managed.

Q2: What is a "quiet title" action?

A quiet title action is a lawsuit filed to establish a clear, clean title to a property. It resolves any competing claims or unrecorded interests, making the property easier to sell or finance.

Q3: Can I get financing for a tax delinquent property?

Traditional bank financing is typically not available for properties bought at a tax sale, as the title is not considered "clean" until a quiet title action is complete and the redemption period has passed. You will almost always need cash or private funding.

Q4: How much money do I need to start?

This depends on the specific property and the type of sale (lien vs. deed). Some tax liens can be purchased for a few hundred dollars, while tax deeds can run into the tens of thousands.

Conclusion: Lists as a Business Growth Engine

A tax delinquent property list isn’t just a collection of data; it’s a powerful tool for generating a predictable stream of low-competition deals.

By understanding the data, performing meticulous due diligence, and building a systematic workflow, you can turn these lists into a core growth engine for your real estate business.

Ready to find your next off-market deal? Access our specialized data solutions with exclusive Tax Delinquent Properties — and start serving your clients with confidence. Reach out now.