While the headline-grabbing areas consistently top lists of the richest zip codes in US in 2025.

The real opportunity for savvy real estate investors lies not in buying the most expensive house, but in mastering the strategies that unlock off-market inventory in these elite neighborhoods.

This guide provides a playbook for identifying, acquiring, and executing deals in and around America’s most affluent markets, transforming the question of “what is the wealthiest zip code in America” into “how do I profit from it?”

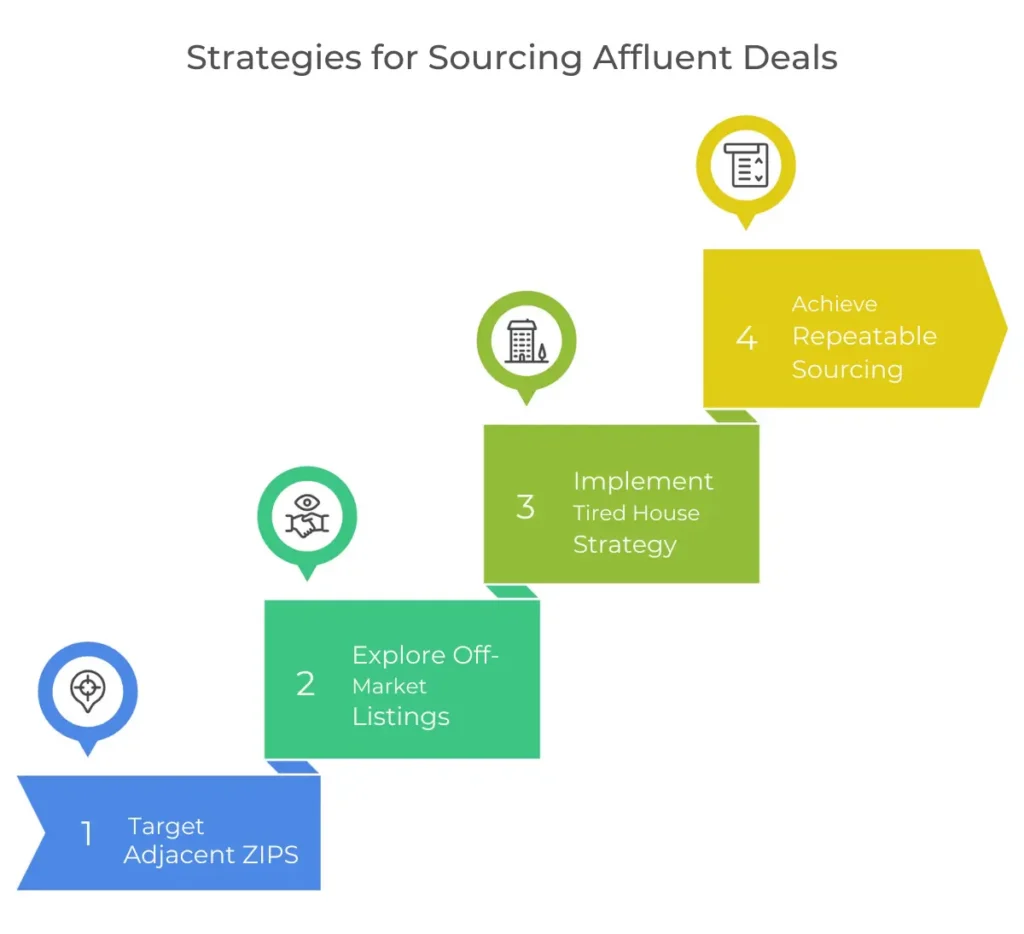

Identifying the Hidden Gold: Strategies for Sourcing Affluent Deals

To compete in markets defined by the richest area codes in USA, you must look beyond the standard Multiple Listing Service (MLS). The genuine deals are found at the intersection of psychology, geography, and public data.

The “Spillover Effect” Analysis (Identifying Adjacent Value)

Forget trying to bid against institutional buyers in the absolute wealthiest zip code in the united states. Instead, target adjacent neighborhoods where the current average prices are reliably $100k–$300k less than the luxury core.

This is where the “spillover effect” generates predictable, next-wave appreciation.

Look for strong indicators:

- Excellent Public School Ratings: This is a key driver of wealth migration. Affluent families will move one zip code over for a top-rated school district, even if it means slightly older housing stock.

- Recent Commercial Revitalization: The introduction of high-end lifestyle amenities—new upscale restaurants, boutique retail, or artisanal grocery stores—is a clear signal that wealth is moving in.

Beyond the MLS: Tapping Off-Market Inventory

Affluent sellers value privacy and speed over minor price differences. Your goal is to become the private buyer who solves their problem.

- Expired Listings: Affluent sellers hate the stigma of their home not selling publicly. Reach out privately with a discreet, tailored solution. They are often highly motivated to find a quiet, private buyer (i.e., you).

- Probate & Estate Sales: Target properties owned by trusts or estates. These deals are often non-emotional; the sellers (or their fiduciary) prioritize a fast, hassle-free close over achieving the absolute top dollar.

- Public Records Mining: Identify properties with high equity, low debt, and long-term ownership (20+ years). These “tired” owners are the most likely to sell off-market if presented with a no-fuss acquisition.

The “Tired House” Strategy

Focus your acquisition efforts on the oldest, least-updated home in the absolute best micro-location within the area. The underlying value is not in the outdated structure; the value is entirely in the land and the prestigious address. You are buying the scarcity of the location.

Pro Tips:

Pro Tips:

- Host exclusive events for CPAs and Estate Attorneys to position yourself as a quiet liquidity partner.

- Automate data checks to flag properties where the mailing address differs from the property address.

- Offer 100% digital due diligence (3D scans/reports) to eliminate showing inconvenience and guarantee discretion.

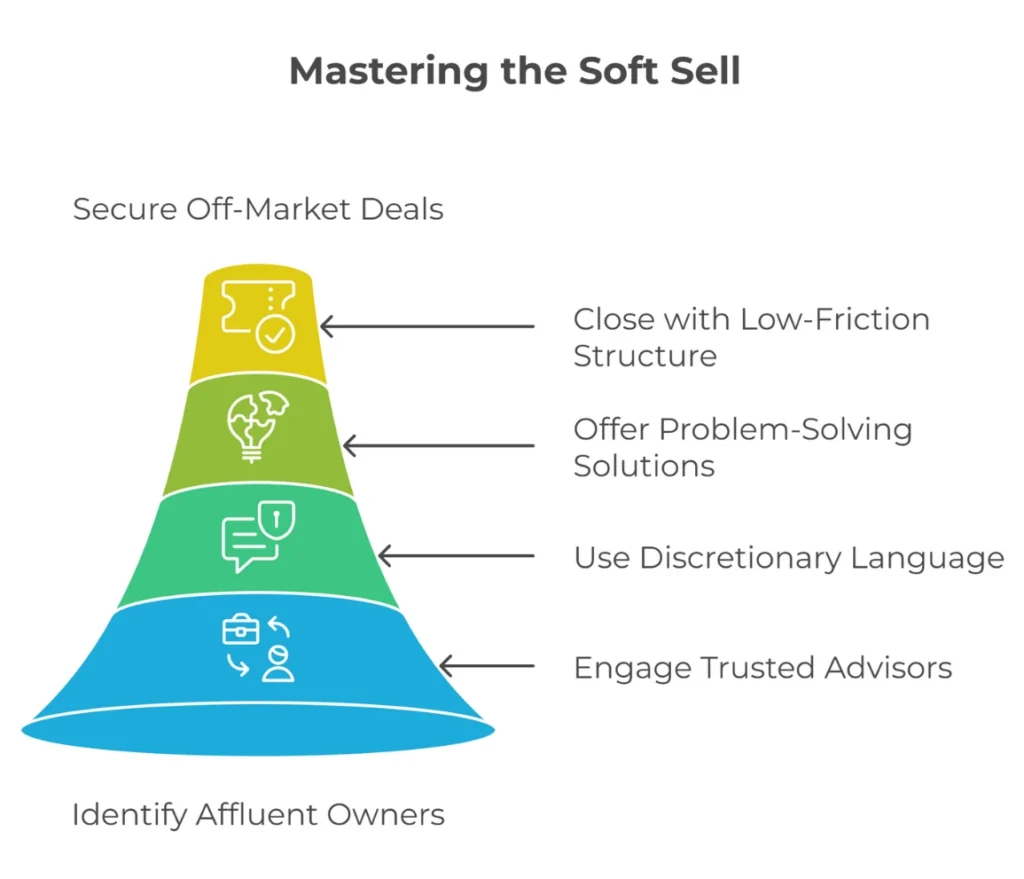

Mastering the Soft Sell: Building Trust with Affluent Owners

Acquiring a property in the top 100 richest zip codes in usa requires a shift from a transactional approach to a consultative one. You are selling discretion and service, not just a price.

The Trust Triangle (Attorneys, Wealth Managers, CPAs)

The key to affluent sellers is their trusted circle. Your initial approach should be through their fiduciary—their attorney, wealth manager, or CPA—not directly to the owner.

You are selling a solution for their client (speed, privacy, no-hassle sale), not an aggressive offer on the house. Be prepared to pay ethical referral fees or, where appropriate, offer co-investment opportunities to these professionals.

The Language of Discretion and Service

In this market, language matters. Avoid “investor jargon” entirely:

- NEVER use terms like “low-ball offer,” “flipping,” or “distressed property.”

- DO use “client-centric” language focusing on solutions: “private disposition,” “expedited closing,” or “handling the entire transition with absolute confidentiality.”

The Problem-Solving Pitch

Understand the seller’s primary motivation, which is often non-monetary. Is it time? Stress? Privacy?

Tailor your offer to solve their most urgent non-monetary problem.

For an estate, the problem might be clearing the property quickly; your pitch should focus on a 14-day, all-cash close.

Strategic Execution: Navigating Competition and Pricing

Once the property is acquired, renovation and resale strategy must be surgically precise to maximize returns without overshooting the market.

Avoid the “Pricing Mistake”: Over-Renovating

The major error in luxury renovations is over-capitalizing the home. Research the ceiling price for the sub-market.

Do not install expensive, bespoke finishes (like gold-plated fixtures or museum-quality appliances) that push the total project cost beyond what local comps will support.

Invest heavily in irreplaceable value drivers (high-end landscaping, custom entryways, maximizing views) over mere size or flash.

Competitive Bidding Strategy (Going Beyond Price)

In competitive scenarios, the quality of your contract can win the deal, even if your price is slightly lower.

- Clean Contract: Offer minimal contingencies and a significantly shortened due diligence period (e.g., 7 days). For affluent sellers, a guaranteed, fast closing is often more valuable than an extra few thousand dollars.

- Proof of Funds (The Credibility Factor): Always submit a clean, easily verified Proof of Funds letter from a recognized private bank. Credibility is everything in high-stakes negotiations.

The Luxury Negotiation Playbook

Be prepared to negotiate unique deal terms. Negotiations in the richest zip codes in US frequently revolve around fixtures, furnishings, art, or even temporary post-close occupancy, not just the final sale price.

Unlocking Value: The Unique Opportunity of Vacancy

A vacant home in an elite zip code is often a clear signal of a motivated, non-resident seller—a prime target for your off-market efforts.

Vacancy as a Signal of Distress (Affluent Edition)

In the high-end market, vacancy rarely means “move-in ready.” It usually means the owner is deceased, financially strained, or out-of-state. This signals high motivation.

Actionable Tip: Use public data tools to search for the property’s mailing address. If it differs from the property address, it’s a strong indicator of a non-resident owner who is ripe for a quiet, unsolicited offer.

The Cost of Carrying Luxury

The burden of owning a vacant, high-end property is immense. Highlight to the seller that the high property taxes, utilities, insurance, and HOA fees create significant carrying costs.

Your job is to frame your offer as the immediate, final solution that makes those costs stop immediately with a fast close.

Security and Maintenance as Leverage

Mentioning your offer to take over the property “as-is” and immediately assume maintenance liability removes a major security and financial headache for a remote, affluent owner. This value-add can sway the negotiation in your favor.

FAQs

Q: Why is public school rating so critical when investing in the wealthiest zip codes?

Excellent public school ratings are a core driver of wealth migration. Affluent families prioritize education, and the quality of local schools acts as a reliable floor for property values and guarantees sustained demand, even in markets adjacent to the core luxury areas.

What is the most important document to have when making a competitive offer in this market?

A clean, easily verifiable Proof of Funds (POF) letter from a recognized private bank. This establishes immediate credibility and assures the seller that the deal will close quickly without financial hiccups, often outweighing a marginally higher price.

In the richest area codes in USA, is it always necessary to pay a premium for views or land?

Yes. When executing a remodel, the highest return on investment comes from enhancing irreplaceable value drivers (views, irreplaceable landscaping, massive lots). Avoid pushing the cost ceiling with unnecessary interior features that the sub-market won't support.

Conclusion: The Long-Term Wealth Play

Mastering the affluent market requires a disciplined focus on discretion and service.

By shifting your approach from high-volume transactions to high-value, private acquisitions, you gain access to assets with unparalleled stability and predictable appreciation.

Use these strategies to step outside the competitive bidding wars and secure your position among the elite investors who profit from the richest area codes in USA.

Ready to unlock your first high-value acquisition in the nation’s wealthiest areas? Feel free to reach out to us.