What if you could pocket an extra $4,497 on a property deal?

Distressed properties can do that for you. That’s the average revenue margin by which foreclosure auctions outperformed MLS listings in Q1 2025.

For those in the know, distressed properties aren’t just fixer-uppers; their below market value selling price can be goldmines waiting to be unearthed.

Yes, there are many types of distressed properties and it can be a bit tricky to find them. And yet, savvy investors and realtors close 2-5 extra deals each month by tapping into these properties.

So how do you find the profitable ones before your competition?

This guide gives you the essential knowledge to effectively find distressed properties in 2025, tips to avoid the pitfalls and capitalize on them regardless of your experience level.

Let’s begin by understanding…

Key Takeaways

- Multiple Sourcing Matters: Combine online tools (foreclosure listings, MLS, tax-lien databases) with field tactics (driving for dollars, direct mail) to uncover the full spectrum of distressed properties.

- Financing Strategies: Distressed deals often move quickly—have financing in place (hard money, private lenders, or cash) to capitalize on time-sensitive opportunities.

- Build a Local Network: Relationships with attorneys, title companies, contractors, and other investors can surface off-market opportunities and streamline your transactions.

- Ethical & Legal Compliance: Respect local regulations (fair marketing practices, code enforcement) and maintain transparency with sellers to protect your reputation and reduce legal risks.

What are Distressed Properties and Their Types

So, what is a distressed property? Simply put, a distressed property is real estate that’s facing big challenges, usually financial or physical. The owners might be struggling with mortgage payments, behind on taxes, or unable to afford necessary repairs. These situations often mean the property needs to be sold quickly, which can create fantastic buying opportunities for investors. Think of it as a property signaling an S.O.S.

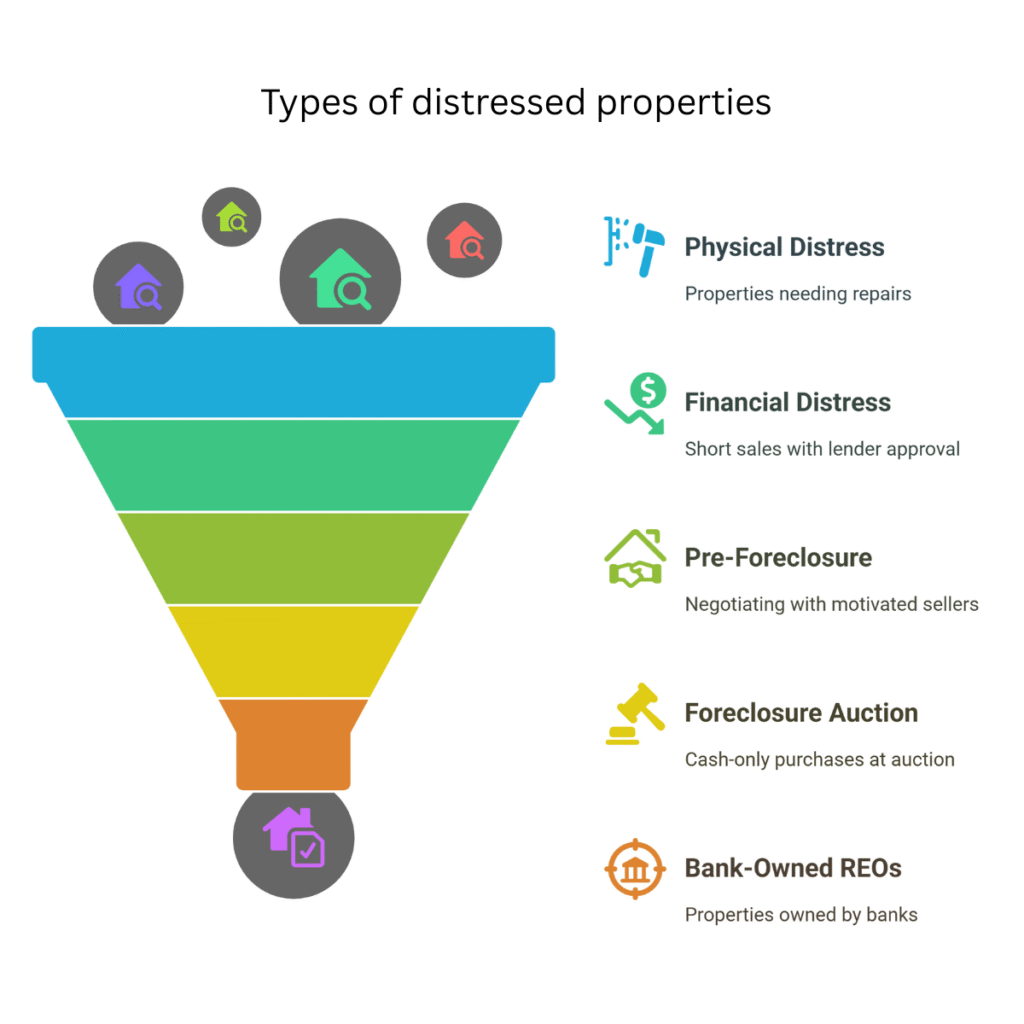

Common Types of Distressed Properties

1. Physically Distressed Properties

This type of distressed property needs significant repairs due to neglect, damage, or simply being old and outdated. You can often spot these by tell-tale signs like overgrown yards, boarded-up windows, or visible structural damage. Typically purchased at 40-50% below market value, they’re perfect for fix-and-flip projects or long-term value plays.

2. Financially Distressed Properties (Short Sales)

These are properties where owners owe more than the home’s value and negotiate with lenders to sell below the mortgage balance. They typically have “short sale approved” in listings. Expect 3-6 month closing timelines but 10-20% discounts.

3. Pre Foreclosure Properties

These are homes where owners have defaulted on payments but haven’t yet been auctioned. Spot them by checking county clerk filings or services like REI Data Solutions. Here, you get to directly negotiate with motivated sellers and can yield 15-30% discounts.

4. Foreclosure Auction Properties

This is the next stage of pre-foreclosure where properties are sold at public auction by lenders. Identifying through auction notices in local papers/courthouses. These are cash-only purchases with no inspection contingencies, but potential for 30%+ discounts.

5. Bank-Owned REOs

Properties that failed to sell at auction and are now owned by banks. Find them in MLS by searching for “REO” designations. These are often vacant and winterized, with clearer titles than auction properties.

6. Government-Owned REOs

These are foreclosures backed by federal agencies (Fannie Mae, HUD, VA). They are often purchased through first-time buyer programs with low down payments. Look for HUDHomestore.com listings or purchase bulk leads from REI Data Solutions.

7. Tax Deed Sale Properties

Homes sold by counties for unpaid property taxes. Note that they may have redemption periods where original owners can reclaim the property.

8. Tax Lien Certificates

Not the property itself, but the right to collect unpaid taxes plus interest. Potential payoff is 8-36% returns if owners repay, or eventual property ownership if they don’t.

9. Divorce-Related Properties

Homes being sold quickly due to marital dissolution. They come with some tell-tale signs like “Must sell” in listings with vague reasons. These emotionally-driven sellers often accept below-market offers.

10. Probate Properties

These real estate are inherited by heirs and are looking for quick sales. Find them at the estate attorneys or probate court records. The heirs typically prioritize fast closes over maximum price.

Now that we have a good understanding of what distressed properties are, let’s look at the tricks to find them.

How to Locate Distressed Properties

So, how to find distressed properties? They aren’t always listed where you’d expect. You need to know where to look beyond the standard Multiple Listing Service (MLS)

Finding these properties requires a proactive and strategic approach, as they aren’t always listed through traditional channels like the Multiple Listing Service (MLS). Here’s an in-depth look at effective strategies for uncovering these investment opportunities:

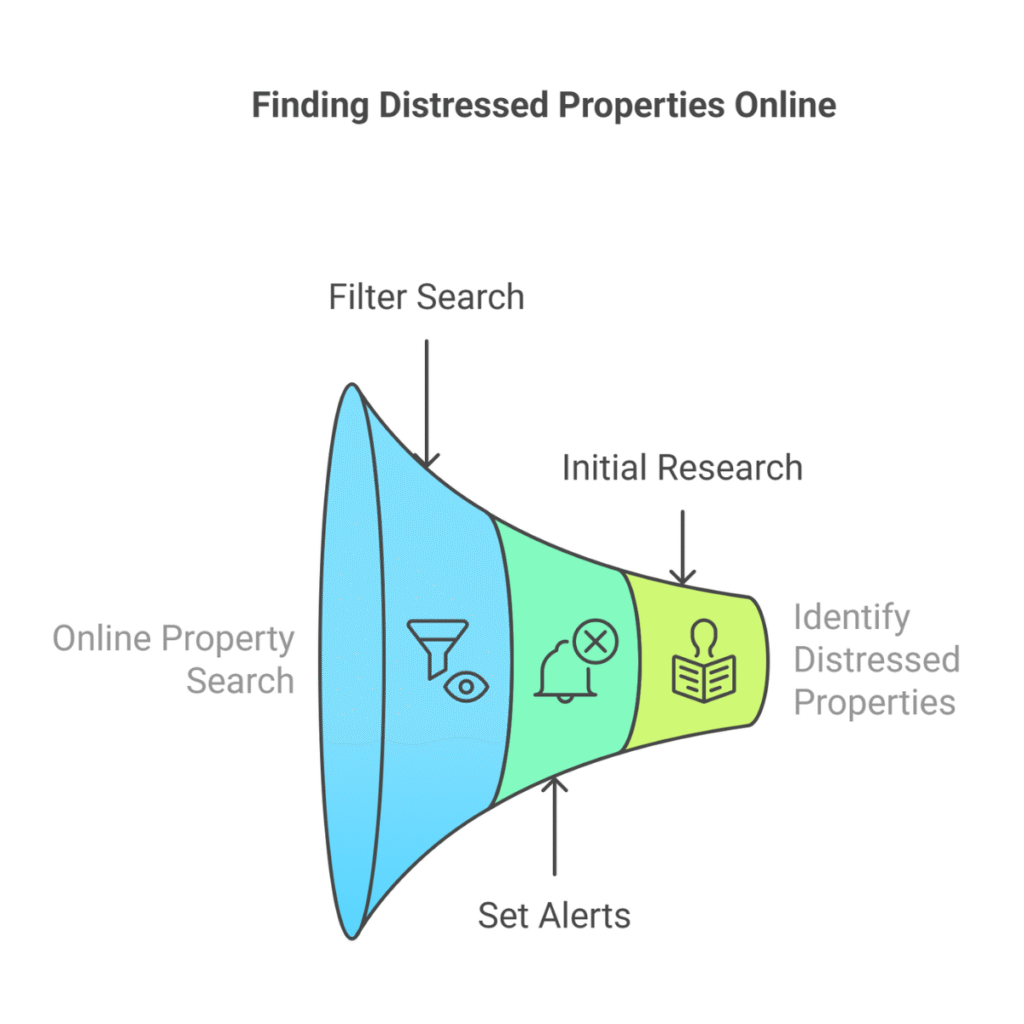

Online Platforms

The internet offers a wealth of resources for finding distressed properties. Websites and online platforms can provide a convenient starting point for your search.

Mainstream Sites

Popular real estate websites like Zillow, Realtor.com, and Redfin are widely used by homebuyers, but they also include listings for damaged properties. These sites allow you to filter your search by keywords like “foreclosure,” “short sale,” or “bank-owned” to identify relevant properties.

Example

On Zillow, you can go to the “Filters” section and select “Foreclosure” under the “Listing Type” to see only foreclosure listings in your target area.

Pro Tip

Set up alerts on these sites to be notified when new damaged properties that meet your criteria become available. This can give you a competitive edge.

Effectiveness

These sites are good for initial research and getting a general overview of distressed property availability in a given area. However, they may not always have the most up-to-date information, and you’ll likely face competition from other buyers.

Auction Sites

Specialized websites focus specifically on listing properties that are being sold at auction, many of which are foreclosed properties. These sites provide details about upcoming auctions, property information, and bidding procedures.

Examples

Auction.com and RealtyTrac are well-known platforms for finding foreclosure auctions.

Pro Tip

Thoroughly research the auction process and property details before bidding. Be prepared to act quickly and have your financing in order.

Effectiveness

Auction sites can be a source of deals, but they also come with risks. Properties are often sold “as-is,” and you may not be able to inspect them thoroughly before bidding.

Bank Websites

Many banks and lenders that handle foreclosures list their REO properties directly on their websites. Checking the REO or “bank-owned properties” section of these websites can uncover potential opportunities.

Example

Large national banks like Bank of America or Wells Fargo often have a section on their site dedicated to REO properties.

Pro Tip

Build relationships with asset managers at banks to get notified of new REO listings before they’re widely publicized.

Effectiveness

Going directly to bank websites can sometimes give you access to deals with less competition, but it requires consistent monitoring of multiple websites.

Investor Platforms

Some online platforms cater specifically to real estate investors and offer tools and features to streamline the process of finding and analyzing distressed properties. These platforms may provide data on property history, market trends, and potential profitability.

Examples

Mashvisor Property Marketplace and BiggerPockets are examples of platforms that can be helpful for investors.

Pro Tip

Utilize the analytical tools on these platforms to quickly assess the potential ROI of different properties.

Effectiveness

Investor platforms can save time and provide valuable data, but they often come with a subscription fee.

Public Records and Government Agencies

Public records and government agencies are valuable sources of information for these pro, often providing early indicators of properties in financial trouble.

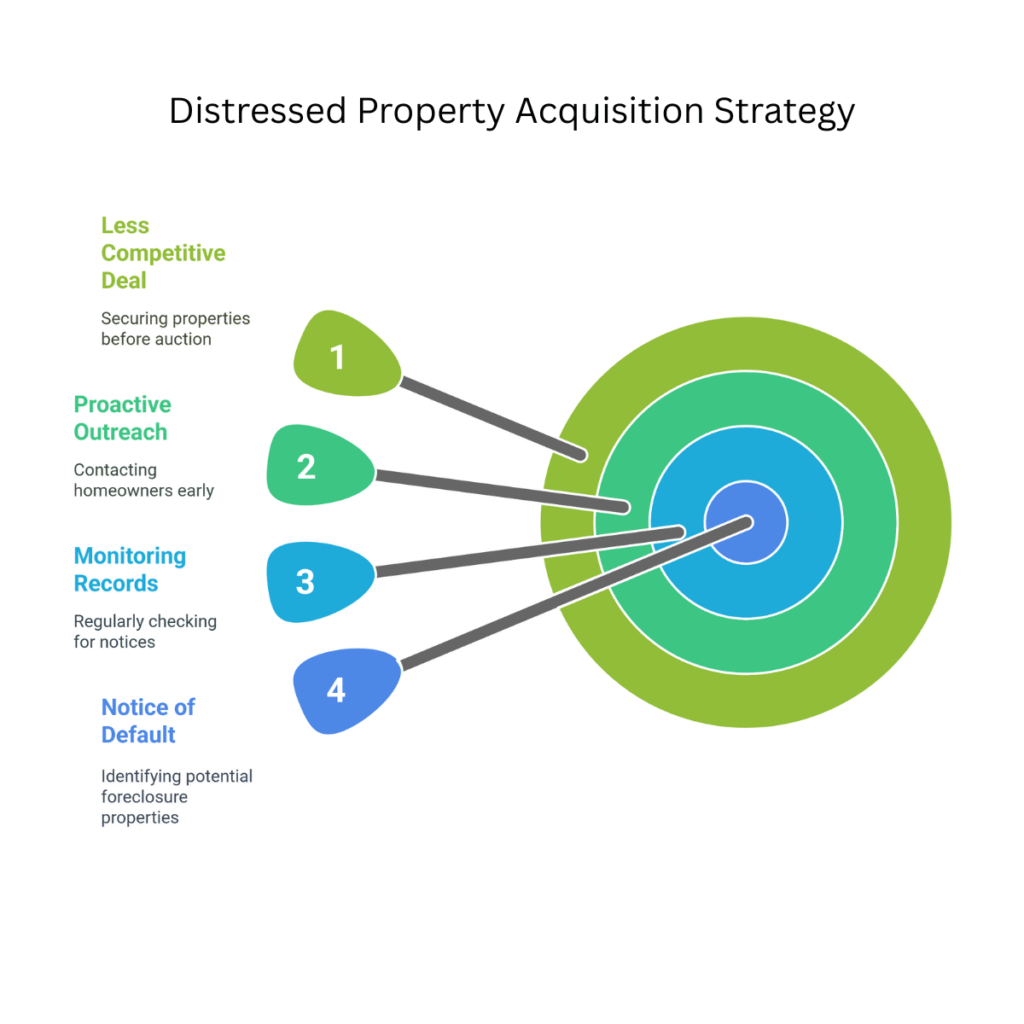

County Clerk’s Office

Explanation

The county clerk’s office maintains records of various legal documents related to real estate, including pre-foreclosure notices. A “Notice of Default” or “Lis Pendens” is a public record that indicates a homeowner has fallen behind on their mortgage payments and the foreclosure process has begun.

Example

You can visit the county clerk’s office in person or check their website (if available) to search for these notices.

Pro Tip

Tracking pre-foreclosure notices allows you to contact homeowners before the property goes to auction, potentially leading to a less competitive deal.

Effectiveness

This method can provide early leads, but it requires consistent monitoring of records and proactive outreach to homeowners.

Tax Assessor’s Office

The tax assessor’s office keeps records of property taxes. Properties with delinquent or unpaid taxes may indicate financial distress.

Example

You can check the tax assessor’s website or visit their office to find information on tax-delinquent properties.

Pro Tip

Tax-delinquent property lists are public information and can be a source of leads. Be aware of the laws and regulations regarding tax lien sales in your area.

Effectiveness

This method can uncover properties that may not be listed elsewhere, but it requires an understanding of tax lien processes.

Government Agencies

Government agencies like the Department of Housing and Urban Development (HUD) sell foreclosed homes that were insured by the Federal Housing Administration (FHA).

Example

The HUD website lists HUD homes for sale, often at discounted prices.

Pro Tip

HUD homes often have specific requirements and bidding processes, so familiarize yourself with the rules.

Effectiveness

HUD homes can be a good source of affordable properties, but they may need repairs and have a competitive bidding process.

Off-Market Strategies (Finding Hidden Gems)

Off-market strategies involve finding distressed properties before they are widely advertised. These methods require more effort but can lead to less competition and better deals.

Real Estate Agents

Building relationships with real estate agents who specialize in these properties or work with investors can provide access to exclusive listings or “pocket listings” that are not yet on the MLS.

Example

Seek out agents who advertise themselves as investor-friendly or who have a track record of selling foreclosures.

Pro Tip

Network with agents at real estate investor association meetings or online forums.

Effectiveness

Agents can provide valuable expertise and access to deals, but you’ll typically need to pay them a commission.

Wholesalers

Real estate wholesalers find damaged properties, sign a contract with the homeowner to purchase the property, and then “assign” that contract to an investor for a fee. The investor then buys the property from the homeowner.

Example

Wholesalers often find properties through methods like direct mail or driving for dollars.

Pro Tip

Build relationships with reliable wholesalers who have a good track record.

Effectiveness

Wholesalers can bring you deals, but you’ll need to factor in their assignment fee.

Driving for Dollars

This involves physically driving or walking through neighborhoods to identify properties that show signs of distress or neglect.

Example

Look for houses with overgrown lawns, boarded-up windows, peeling paint, or other signs of deferred maintenance.

Pro Tip

Keep a detailed record of addresses and property conditions. Use a spreadsheet or app to organize your findings.

Effectiveness

This method requires time and effort but can uncover hidden gems that other investors miss.

Direct Mail

Sending targeted letters or postcards to homeowners who are likely to be in distress can generate leads. You can obtain lists of potential leads from public records or specialized data providers.

Example

Send letters to homeowners who are behind on property taxes or facing pre-foreclosure.

Pro Tip

Craft compelling letters that offer solutions to the homeowner’s problems.

Effectiveness

Direct mail can be effective, but it requires careful targeting and follow-up.

Specialized Data Services

Companies like PropStream or BatchLeads provide data and tools to help investors find off-market leads. These services may offer lists of properties in probate, tax-delinquent properties, code violations, and other indicators of distress.

Example

Use PropStream to generate a list of all properties with code violations in a specific zip code.

Pro Tip

Utilize the filtering and sorting capabilities of these services to narrow down your search and focus on the most promising leads.

Effectiveness

Data services can significantly enhance your search efficiency but come at a cost.

Why a Distressed Property Can Be a Goldmine

Investing in a damaged property isn’t just about getting a cheap house; it’s a strategic move with several powerful advantages.

Lower Purchase Price

This is the big one. You can often buy a foreclosed property at a significant discount compared to other homes. Sellers, especially banks with REO properties, want a quick sale and may price the property aggressively. Fix-and-flip deals on distressed homes averaged $40,000 profit per property in 2025 (source)

Significant Potential & Value Creation

Many distressed properties are like hidden gems. They might look rough, but with the right renovations, you can massively increase their value. This is perfect for a “fix-and-flip” strategy, where you buy, renovate, and sell for a profit. It’s your chance to turn a neglected house into a desirable home.

High Return on Investment (ROI) Potential

Buying low and adding value through smart renovations can lead to big profits. Of course, you need to do your homework and calculate all costs carefully to make sure the numbers work for a strong ROI on your distressed property investment.

Reduced Competition

Many regular homebuyers are scared off by properties that need a lot of work or have complicated sales processes. This means less competition for investors who understand the foreclosed property market.

Creative Financing Opportunities

Because sellers of distressed real estate are often motivated, they might be open to non-traditional financing, like seller financing (where the seller acts like the bank) or “subject-to” deals (where you take over their existing mortgage payments).

Rental Income Potential

Once renovated, a foreclosed property can become a great source of rental income, providing steady cash flow.

Positive Community Impact

Fixing up a run-down distressed property doesn’t just benefit you; it helps improve the whole neighborhood. This can lift other property values and provide much-needed quality housing.

Legal and Regulatory Considerations for Distressed Property

Navigating the legal side of damaged property investing is crucial. Overlooking this can lead to costly mistakes.

Title Issues and Liens

A Must-Do

Always get a thorough title search from a reputable title company. This will uncover any liens (e.g., from unpaid contractors, back taxes, or court judgments), easements, or other claims against the distressed property.

Protection

Purchase title insurance to protect yourself against unforeseen title problems.

Understanding the Foreclosure Process

The process varies, but generally includes:

Pre-foreclosure

The owner is behind on payments but still owns the property. This is often a good time to approach them for a potential deal.

Foreclosure Auction

If the owner can’t resolve the debt, the property is sold at a public auction.

REO (Real Estate Owned):

If no one buys it at auction, the lender takes ownership.

Each stage of a distressed property foreclosure presents different opportunities and challenges.

State and Local Laws are Key:

- Foreclosure rules (judicial vs. non-judicial), redemption periods (time the original owner has to reclaim the property after sale), and tax sale processes differ significantly from state to state and even county to county.

- Advice: Consult with a local real estate attorney who knows the ins and outs of damaged property laws in your area.

Code Violations and Permitting

- As the new owner, you’re responsible for fixing any existing code violations on the distressed property.

- You must also get the proper permits for all your renovation work. Don’t skip this!

Zoning and Land-Use Compliance

Verify the property’s current zoning. Make sure your intended use (e.g., rental, flip, multi-unit) is allowed. Check for any upcoming zoning changes too.

Understanding Context and Timing for Distressed Real Estate

Smart investing in distressed real estate means understanding the broader market.

Real Estate Cycles

Markets move in cycles: recovery, expansion, hyper-supply (too much inventory), and recession. Different sectors (like homes vs. commercial buildings) might be in different phases. Knowing this helps you spot opportunities for distressed property deals.

Investing in Recessed Markets

Economic downturns can actually create more property in poor condition opportunities as prices may fall and competition lessens. However, be cautious.

Risks in Recessed Markets

It’s hard to predict when the market will hit bottom. Financing can be tighter, finding good tenants might be harder, and renovation costs can still be high.

Monitor Economic Indicators

Keep an eye on:

- Interest rates

- Employment rates

- Population growth

- Gross Domestic Product (GDP)

- Even global events can impact local distressed property markets.

Identify Emerging Growth Markets

Look for areas showing signs of recovery or growth:

new businesses opening, infrastructure improvements, gentrification, or positive population shifts. These areas can be ripe for damaged property investments.

Assessing Your Suitability for Distressed Investing

Before diving into the world of these properties, take an honest look at yourself:

Risk Tolerance

How comfortable are you with uncertainty and potential big, expensive surprises? Distressed property investing can be a rollercoaster.

Experience Level

Do you have a background in real estate, renovations, or project management? If not, are you willing to learn fast and rely on a good team?

Time Commitment

Finding deals, managing projects, and handling the sale or rental of a distressed property takes a LOT of time. Is your schedule flexible enough?

Financial Situation

Do you have access to cash or financing for the purchase, renovations, and holding costs? Remember, financing a distressed property can be tougher.

Access to a Network

Can you build or do you already have a reliable team of agents, contractors, inspectors, and lenders who understand distressed real estate?

This isn’t a get-rich-quick scheme. Investing in a foreclosed property is an active, hands-on strategy that requires hard work, knowledge, and resilience.

Addressing Challenges and Risks of Distressed Property Investing

While the rewards of investing in a property in poor condition can be huge, it’s not without its challenges. Being aware of the risks is key to making smart decisions:

Uncertain Property Condition & High Renovation Costs

The Issue

Many damaged properties are sold “as-is.” This means they could have hidden problems like a leaky roof, foundation issues, or outdated electrical systems that are expensive to fix.

The Fix

Always, always get a thorough inspection from a qualified professional. It’s wise to overestimate repair costs and have a contingency fund (around 15-20% of your renovation budget) for surprises.

Legal and Financial Complications:

The Issue

A damaged property can come with legal baggage like liens (claims for unpaid debts), title problems, unpaid property taxes, or judgments against the owner. Sorting these out takes time and money. Dealing with bank-owned properties can also be a slow, complicated process.

The Fix

A comprehensive title search before you buy is absolutely essential. Consider consulting with a real estate attorney who specializes in distressed real estate.

Location Concerns & Market Volatility

The Issue

Not every damaged property is in a great neighborhood. A poor location can limit how much the property’s value can grow. The market for distressed sales can also be more sensitive to economic ups and downs.

The Fix

Research the local area thoroughly. Look at property value trends, average rents, and future development plans.

Time and Effort

The Issue

Finding good derelict property deals, managing renovations, and then selling or renting the property takes a significant amount of time and effort. This is not a passive investment.

Financing Hurdles

The Issue

Traditional banks can be hesitant to lend money for properties in poor condition.

The Fix

Explore alternative financing options, which we discuss below.

Persistence Required:

The Issue

Success in distressed property investing rarely happens overnight. It requires patience, dedication, and good problem-solving skills.

FAQs

Q1: What's the biggest mistake beginners make when investing in distressed properties?

Underestimating renovation costs and timelines, and skimping on due diligence. Always get a thorough inspection for any distressed property and have a good contingency fund (15-20% extra).

Q2: Can I really get a good deal with distressed properties?

Yes, significant discounts on a distressed property are possible, but they come with increased risk and work. The "deal" isn't just the purchase price; it's the final profit after ALL expenses.

Q3: How much money do I need to start investing in distressed properties?

It varies wildly by location, property type, and how you finance it. While some creative financing for a distressed property requires less cash upfront, you'll still need funds for down payments (if any), closing costs, immediate repairs, and holding costs.

Q4: Is investing in distressed properties ethical?

When done responsibly, absolutely. Investors can help homeowners avoid the worst parts of foreclosure, improve the housing stock, revitalize neighborhoods, and provide quality homes for buyers or renters. The key is dealing fairly and creating win-win solutions around the distressed property.

Q5: What exactly are distressed properties again?

A distressed property is real estate facing serious financial problems (like foreclosure risk) or physical problems (needing major repairs due to neglect). Common types include foreclosures, short sales, bank-owned (REO) properties, and homes needing significant rehab.

Q6: Why are distressed properties considered a "goldmine" for investors?

Because a distressed property is often priced below its true market value. This offers a big opportunity to add value through renovations and achieve potentially high returns when the property is sold or rented out.

Q7: What are the main risks with investing in distressed properties?

Key risks for any distressed property include unknown property conditions leading to high repair costs, legal and financial headaches (like liens or title problems), difficulties getting traditional financing, and the sheer amount of time and effort required.

Q8: Where can I find distressed properties for sale?

You can find these properties through online platforms (Zillow, Auction.com), public records (county clerk for pre-foreclosures, tax assessor for tax issues), government agencies (like HUD for foreclosed homes), and off-market strategies such as driving for dollars, direct mail campaigns, or using specialized data services to find distressed property leads.

Q9: What kind of due diligence is crucial for distressed properties?

For any distressed property, thorough due diligence is a must! This includes a comprehensive property inspection by a professional, a detailed title search for liens or claims, deep research of the local market and comparable sales (comps), and a full review of all property records.

Q10: How can I finance a distressed property if banks are hesitant?

If traditional banks say no to financing a distressed property, common alternative options include cash offers, hard money loans (short-term private loans for buying and fixing), private money loans from individuals, bridge loans, FHA 203(k) loans (for primary residences needing rehab), creative financing like seller financing or "subject-to" deals, pooling money with investor partners, or using a Self-Directed IRA (SDIRA).

Conclusion

Distressed properties remain one of the most lucrative—yet overlooked—opportunities in real estate.

These undervalued assets can deliver serious ROI when approached strategically. But let’s be real: finding the right damaged properties is half the battle.

Scouring county records, stalking auctions, and cold-calling pre-foreclosure leads can eat up hundreds of hours—time better spent closing deals. REI Data Solutions can save that time for you by getting you targeted, highly-motivated seller leads in bulk.

The best part?

You can try us risk-free with a 7-day free trial. Claim it and find the next deal before your competitor.

Based in Canada? Claim offer here.