Real estate pros risk leaving tens of thousands on the table when they treat pre-foreclosures and foreclosures the same.

Each stage comes with different seller motivations, timelines, and deal structures—and using the wrong approach can kill a great opportunity.

This guide breaks down what makes or breaks deals at each stage, so you can tailor your strategy, maximize ROI, and outmaneuver less-informed investors.

Key Takeaways for Savvy Investors & Realtors:

- Pre-foreclosure is the initial, critical stage after missed payments, offering homeowners more options and investors less competition for off-market deals.

- Foreclosure is the final, legal stage, typically leading to public auction or bank ownership, with properties often sold “as is.”

- Opportunity Windows: Homeowners have more flexibility to resolve issues during pre-foreclosure, which translates to a prime window for investors to negotiate direct purchases.

- Strategic Advantage: Both stages offer unique opportunities and risks for real estate investors and buyers, but understanding the nuances is key to success.

- Professional Guidance: Seeking expert support—both for homeowners and for buyers—is crucial for navigating these complex transactions.

Understanding Pre-Foreclosure: Your Early Opportunity Window

What is Pre-Foreclosure?

Pre-foreclosure refers to the period before a property is officially foreclosed and auctioned off. It’s a crucial early warning sign that presents a unique opportunity for proactive real estate professionals.

Trigger

This phase typically begins when a homeowner defaults on their mortgage payments, usually after missing several payments (often around three consecutive months or 90 days late).

Notice of Default (NOD)

The process is formally triggered when the lender issues a Notice of Default (NOD) to the borrower. This legal warning signals that the property is at risk.

Homeowner Ownership

Importantly, during pre-foreclosure, the homeowner still retains legal ownership of the property. This is a critical distinction that opens doors for negotiation.

Public Record

In many states, the Notice of Default becomes a matter of public record. This is where specialized data services, like those offered by REI Data Solutions, become invaluable for identifying these properties early.

The Pre-Foreclosure Timeline: Act Fast, Gain an Edge

The duration of this phase can vary significantly by state and individual circumstances, ranging from a few weeks to over a year. Some sources suggest it typically lasts 3-10 months, or possibly 1-3 months after the Notice of Default is filed.

Why Acting During Pre-Foreclosure is Crucial for Investors

This is your prime window of opportunity. The lender has signaled risk, but the homeowner still has options to address the default. Lenders are often willing to work with homeowners during this phase to find a solution and avoid full foreclosure.

Less Competition

Unlike properties on the open market, pre-foreclosures often have less competition, especially when identified early through specialized data.

Direct Negotiation

This stage allows for direct negotiation with motivated sellers, potentially leading to off-market deals below market value.

Win-Win Scenarios

You can structure deals that benefit both the homeowner (avoiding foreclosure, preserving credit) and your investment goals.

Client Success Spotlight

Sarah, a realtor in Ohio, leveraged REI Data Solutions’ targeted pre-foreclosure data. She connected with a homeowner early, facilitating a win-win short sale that saved the homeowner’s credit and secured a prime investment for her client, all before the property even hit the public auction block.

Understanding Foreclosure: The Final Stage & Its Implications

If the situation isn’t resolved during pre-foreclosure, the process moves to the next, more severe stage: foreclosure.

What is Foreclosure?

Foreclosure is the final legal step in this process, which leads to the eventual sale of the property to satisfy the outstanding debt.

- Legal Action: It happens when formal legal action has been taken by the lender.

- Loss of Ownership: At this stage, the property owner has lost, or is in the process of losing, legal ownership of the property.

The Foreclosure Process: What Happens Next?

This stage typically begins if the default is not resolved during the pre-foreclosure period. It involves various legal steps that differ based on state laws.

Notice of Sale

A common step is filing a notice of trustee sale, a public announcement of an upcoming auction.

Public Auction

The property is usually sold at a public auction to the highest bidder. The opening bid is often based on the amount owed on the loan, plus any associated costs like liens and taxes.

Judicial vs. Non-Judicial

Depending on state law, the process can be judicial (involving court proceedings) or non-judicial (occurring outside of court, like a power of sale foreclosure).

Transfer of Possession

Once the foreclosure is complete and the property is sold, legal possession transfers to the new owner, and the former homeowner is required to move out.

Foreclosure Properties: “As Is” Opportunities

These are properties that have gone all the way through the foreclosure process and are now often controlled by the lending institution (known as REO – Real Estate Owned properties).

“As Is” Sale

They are frequently sold “as is,” meaning the buyer takes the property in its current condition, often without the opportunity for prior inspection. This can lead to unexpected costs, so due diligence is paramount.

Pre-Foreclosure vs. Foreclosure: Key Differences at a Glance

To make the distinction super clear for your investment strategy, here’s a breakdown of the main differences:

| Feature | Pre-Foreclosure | Foreclosure |

|---|---|---|

| Ownership | Homeowner retains legal ownership | Lender takes legal action; ownership transfers |

| Homeowner Options | High (loan modification, short sale, reinstatement) | Very limited (often only redemption period) |

| Investor Opportunity | Direct negotiation, off-market deals, less competition | Public auction, REO purchases, often “as is” |

| Property Condition | Generally occupied & better maintained | Often vacant, “as is,” potential deferred maintenance |

| Credit Impact | Significant, but potentially less severe than full foreclosure | Severe, long-lasting negative impact |

| Process Start | Notice of Default (NOD) | Formal legal action (e.g., Notice of Sale) |

Opportunities and Risks for Real Estate Investors and Buyers

While challenging for homeowners, understanding pre-foreclosure vs. foreclosure can present significant opportunities for those looking to buy real estate.

Why Target Pre-Foreclosures and Foreclosures?

Discounted Prices

There’s a strong potential to purchase properties at a discounted or below-market price, especially for motivated sellers in pre-foreclosure.

Reduced Competition

Properties in pre-foreclosure often have less competition than those listed on the open market. Targeting properties before they are listed publicly by checking county records can further reduce competition.

Profit Potential

Significant opportunity for profit through strategies like fixing and flipping, or buying and holding as a rental property.

Finding These Properties: Your Data Advantage

Beyond online listings and government foreclosure websites, gaining an edge means leveraging superior data.

Specialized Data Providers

This is where REI Data Solutions excels. We provide accurate and actionable real estate lead data, specializing in off-market property deals and distress property data (probates, FSBOs, divorce properties, foreclosures, preforeclosures). This data often leads to motivated sellers ready to make a deal urgently.

Advanced Skip Tracing

Unlike other services, we combine multiple reliable skip tracing tools to find accurate homeowner and seller information. This ensures data accuracy, helping you easily connect with genuine leads and close deals.

Public Records & Auctions

You can also search public records for notices of default or sale and attend local foreclosure auctions.

Client Success Spotlight

John, an investor in Montreal, leveraged REI Data Solutions’ advanced skip tracing to contact the previous owner of a foreclosed property that didn’t sell at auction. This allowed him to acquire an REO property directly from the bank at a significant discount, turning a challenging situation into a profitable flip.

Real Estate Investment Strategy: Tailoring Your Approach

Your strategy often depends on the property’s condition and stage.Different Investment Strategies and Tips for Both Types of Properties

Understanding the core differences between pre-foreclosure and foreclosure is just the first step. To truly capitalize on these opportunities, you need tailored strategies.

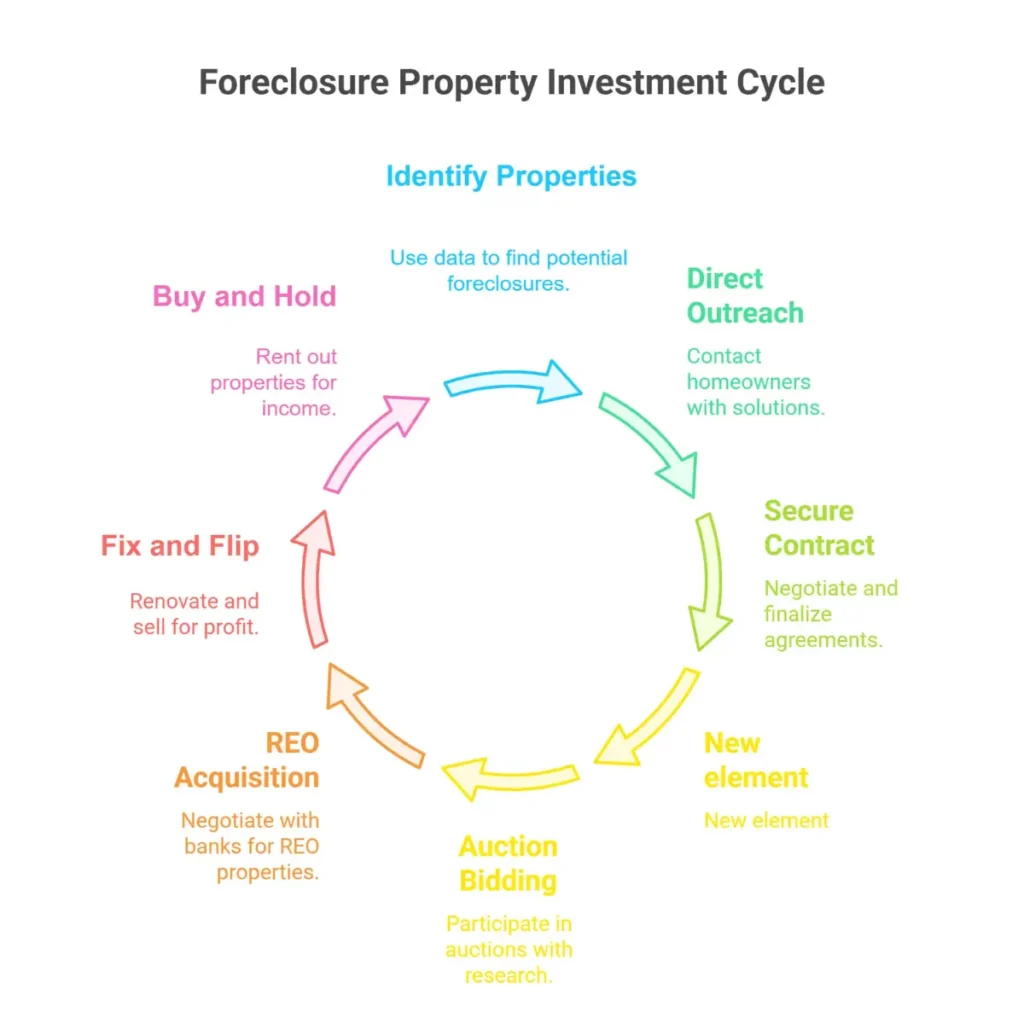

For Pre-Foreclosure Properties

Direct-to-Seller Outreach:

This is often the most profitable approach. Identify pre-foreclosures early using advanced data (like REI Data Solutions provides) and reach out to homeowners with empathetic, solution-oriented offers. Your goal is to provide a way out that benefits them (e.g., quick sale, avoiding foreclosure on their credit) while securing a deal for yourself.

Tip: Focus on problem-solving. Can you offer to buy their home quickly for cash, take over payments, or facilitate a short sale?

Loan Modification/Reinstatement Assistance

While less common for investors, understanding these options for homeowners can make you a valuable resource. If a homeowner can reinstate their loan, they might still consider selling to avoid future issues.

Wholesaling Pre-Foreclosures

Secure a contract with the homeowner and then assign that contract to another investor for a fee. This requires strong negotiation skills and a robust buyer’s list.

Tip: Speed is critical in pre-foreclosure. Have your due diligence and funding ready to move quickly.

For Foreclosure (Auction & REO) Properties

Auction Bidding Strategy

Properties at auction are often sold “as is,” with no prior inspection. You need to do extensive research beforehand, including title searches, property drive-bys (if possible), and understanding local bidding rules. Cash is usually required.

Tip: Factor in all potential repair costs and outstanding liens into your maximum bid. Don’t get caught in a bidding war.

REO (Real Estate Owned) Acquisition

These are bank-owned properties that didn’t sell at auction. They are typically listed with real estate agents specializing in REOs. While still “as is,” you often have more time for inspection and negotiation than at an auction.

Tip: Build relationships with REO agents and banks. They can give you early access to new listings.

Fix and Flip

Many foreclosed properties require significant renovation. This strategy involves buying low, renovating efficiently, and selling for a profit.

Buy and Hold (Rental)

If the property is in decent condition or requires minor repairs, it can be a great addition to a rental portfolio, generating passive income.

Regardless of the strategy, accurate data and professional guidance are your most powerful tools.

Navigating Bank-Owned (REO) Properties

These are properties that the lender now owns because they didn’t sell at auction. They can offer opportunities, but assessing the profit potential requires careful evaluation. They can be acquired through real estate agents, REO listings, or auctions.

Importance of Due Diligence and Professional Guidance (Buyers)

As a general rule, proceed with caution. Do your research and be prepared for potential surprises. It’s highly advisable to consult professionals like real estate agents specializing in distressed properties, legal experts, or investment advisors. Homeowners facing pre-foreclosure should also be cautious of aggressive investors offering lowball offers or using high-pressure tactics. Seeking advice from a trusted real estate professional or attorney is essential before agreeing to anything.

Current Statistics: What the Data Shows

To give you an idea of the current landscape…

Note: The following statistics are from external sources and are included here to add current context to the topic. Please independently verify this information.

- In April 2024, there were 32,888 U.S. properties with foreclosure filings (default notices, scheduled auctions, or bank repossessions). This was down 4% from March 2024 but up 1% from April 2023.

- The number of foreclosure starts (properties receiving a public default notice for the first time) in April 2024 was 22,753, down 10% from March 2024 and down 4% from April 2023.

FAQs

Q1: What is the typical pre-foreclosure timeline?

The pre-foreclosure timeline varies by state, but it typically begins after 3-4 months of missed payments and can last anywhere from a few weeks to over a year after a Notice of Default is filed.

Q3: Can investors buy a foreclosed home "as is"?

Yes, foreclosed homes (especially those sold at auction or as REO properties) are almost always sold "as is." This means the buyer accepts the property in its current condition, and they are responsible for any repairs or hidden issues.

Q4: What are the biggest risks when buying pre-foreclosure properties?

Key risks include inheriting unknown liens or judgments, potential deferred maintenance, and the emotional complexity of dealing with a distressed homeowner. Thorough due diligence, including a title search and property assessment, is crucial.

Q5: How can REI Data Solutions help me find distressed properties?

REI Data Solutions provides specialized off-market property data, including probates, FSBOs, divorce properties, and pre-foreclosures. We also offer advanced multi-tool skip tracing to help you connect with motivated sellers and secure exclusive deals.

Conclusion: Your Path to Distressed Property Success

Hopefully, this guide has cleared up the confusion between pre-foreclosure vs. foreclosure and illuminated the significant opportunities each stage presents for savvy real estate professionals.

The key takeaway for investors and realtors is this: pre-foreclosure is your golden window. It’s the crucial period where homeowners still have ownership and can explore various options to resolve their default, offering you a unique chance for less competitive, off-market deals.

Foreclosure, while riskier, can still present opportunities, particularly with bank-owned (REO) properties.

For homeowners facing missed payments, taking proactive action during pre-foreclosure is absolutely critical to explore your options, communicate with your lender, and try to avoid the more damaging consequences of a full foreclosure.

No matter which side you’re on, navigating these situations requires deep knowledge, meticulous due diligence, and often, professional support.

Ready to seize hidden distressed property opportunities? Contact REI Data Solutions today!