Pre-foreclosure and foreclosures are some of the most coveted property types out there. But it’s hard find the ROI potential foreclosure proeprties and even harder to conenct with the homeowners.

What if you could actually predict where these foreclosures are going to take place?

Yes that’s totally possible if you know where the mortgage delinquency rates are rising.

Our research team did all the legwork and found the Canadian provinces where the mortgage delinquency soaring and indicates a potential rise in pre-foreclosures and foreclosures.

Let’s see where Canada’s emerging foreclosure-risk hotspots are in 2025.

How Do We Pinpoint Canada’s 2025 Foreclosure-Risk Hotspots?

Understanding the subtle indicators of market distress is key to proactive prospecting. By focusing on Arrears and rising mortgage delinquency, we can identify areas ripe for future foreclosure opportunities.

Understanding Delinquency: A Precursor to Opportunity

Mortgage delinquency occurs when a homeowner consistently misses their mortgage payments. It’s a critical early warning sign and a significant precursor to foreclosure.

Factors like rising interest rates (which directly impact monthly payments, making a mortgage simulation or mortgage estimator crucial for homeowners), economic pressures, or shifts in canadian mortgages news can contribute to increased delinquencies.

As seen in recent mortgage trends in Canada, significant payment shocks are expected for the 1.2 million mortgages renewing in 2025, many of which were contracted when the Bank of Canada rate was at or below 1%.

This will directly influence the capacity to pay, leading to increased arrears.

The Path to Opportunity: Delinquency to Foreclosure (Power of Sale/Court Foreclosure)

For real estate professionals, understanding how mortgage delinquency specifically leads to a power-of-sale or court foreclosure in Canada is crucial.

When a homeowner defaults on their mortgage, lenders initiate legal processes to reclaim their investment. In Canada, this often proceeds via a power of sale (where the lender sells the property to recover debt) or a court foreclosure (a judicial process leading to the transfer of property title).

Both scenarios inevitably lead to an urgent sale. These situations frequently involve “motivated sellers who are ready to make a deal urgently” – a prime scenario for savvy investors and agents seeking advantageous terms and rapid transactions.

Provinces to Watch: Your Opportunity Zones for 2025

Based on recent data from sources like CMHC and Equifax Canada, several provinces are exhibiting rising or sustained high mortgage delinquency rates, making them key areas for prospecting in 2025.

While the national mortgage delinquency rate has edged up to around 0.20% (Q3 2024), certain regions show more pronounced distress:

Ontario

This province, particularly the Toronto housing market, is experiencing significant increases in delinquency rates, reaching levels unseen since 2012.

The combination of high home prices, rising interest rates impacting renewed mortgages, and broader economic uncertainty makes this a crucial hotspot.

Our expertise in the toronto property market and housing market in toronto indicates that these trends will create motivated sellers.

British Columbia

Similar to Ontario, BC is seeing a notable rise in delinquencies. High property values and the impact of interest rate increases mean many homeowners face payment shock, leading to increased financial strain.

Saskatchewan

While Saskatchewan currently has the highest mortgage delinquency rate (0.37% in Q1 2025, nearly double the national average), experts indicate its rate is actually falling compared to five years ago, suggesting a different trend than Ontario and BC where rates are worsening.

However, its consistently high rate still points to opportunities for specific, targeted prospecting.

Quebec

This province also experienced a significant increase in mortgage delinquencies (up 41.2% in Q4 2024 year-over-year), indicating growing financial stress for some homeowners.

Atlantic Provinces (New Brunswick, Nova Scotia, Prince Edward Island, Newfoundland and Labrador)

While starting from lower bases, the Atlantic provinces collectively saw an increase in mortgage delinquencies (up 15.7% in Q4 2024), suggesting a growing need for solutions in these markets as well.

Alberta

Notably, Alberta experienced a slight decrease in mortgage delinquencies (down 3.6% in Q4 2024). While this indicates a more stable market compared to others, opportunities for distressed properties still exist, albeit potentially at a slower pace.

Manitoba

Along with Saskatchewan, Manitoba saw a more modest increase in mortgage delinquencies (up 0.6% in Q4 2024), maintaining a relatively stable, though still relevant, market for prospecting.

These provinces, driven by factors like payment shock from renewing mortgages and loans at higher rates, underline why keeping an eye on news on mortgages and mortgage rate rbc or royal bank of canada mortgage rates is essential for any real estate professional.

When evaluating potential deals, quickly being able to calculate a mortgage loan or use a home loans mortgage calculator can provide an edge.

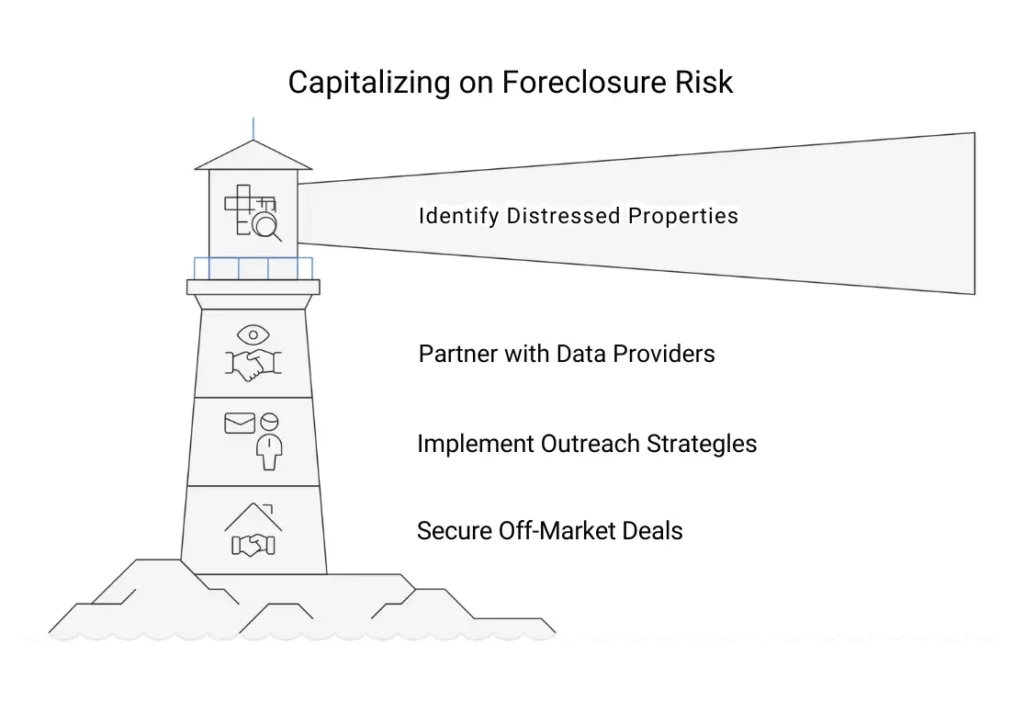

How Can You Capitalize on Foreclosure Risk?

Proactive strategies are essential to effectively leverage the opportunities presented by distressed properties. Success hinges on accurate data, efficient processes, and targeted marketing.

Strategic Lead Generation: Finding High-Quality, Off-Market Deals

The primary challenge for many real estate professionals is the Difficulty finding high-quality, off-market/distressed leads. This is where strategic data solutions become your competitive edge.

Leveraging Data Solutions

Partnering with reliable data providers is essential for Providing accurate and actionable real estate lead data. This gives you access to pre-vetted lists of potential distressed properties and motivated sellers.

Proactive Prospecting Methods

Once you have precise data, it’s time for outreach. Advise on utilizing bulk property owner leads and recommend actively prospecting these leads through proven methods.

This includes targeted cold calling and direct mailing campaigns, which are highly effective for uncovering potential deals before they hit the open market.

The Power of Distressed Properties: Why They are Gold for Real Estate Professionals

Understanding and acquiring distressed properties is a cornerstone of a highly profitable real estate strategy. They represent a distinct and often overlooked market segment with significant advantages.

Defining “Distressed Property”

A distressed property is essentially a real estate asset facing financial or legal duress, prompting an urgent sale. This category includes:

- Pre-foreclosures: Homes where owners are behind on mortgage payments but haven’t yet reached full foreclosure.

- Foreclosures (Power of Sale/Court Foreclosure): Properties legally seized by lenders due to unpaid debts.

- Probates: Properties being sold as part of an estate, often requiring quick liquidation.

- FSBOs (For Sale By Owner): Owners who choose to sell without an agent, often due to urgency or a desire to save on commissions.

- Divorce Properties: Assets needing to be liquidated quickly due to legal separation.

The Unrivaled Benefits

These properties address a critical pain point for many in the industry: Difficulty finding high-quality, off-market/distressed leads. Beyond just solving the lead generation challenge, they offer compelling benefits:

- Lower than market value: Distressed sellers prioritize speed and debt relief over maximizing profit, allowing buyers to acquire properties at a discount.

- Better negotiation opportunities: The seller’s urgency often translates to greater flexibility in terms and pricing.

- Excellent flip and sale opportunities: Acquired at a discount, these properties provide significant room for value-add renovations, leading to substantial profits upon resale. They are the foundation for thriving flip and sale opportunities.

The Crucial Role of Data Accuracy and Skip Tracing

To convert leads into deals, direct and accurate communication is non-negotiable. Without reliable contact details, even the best lead data is useless, slowing down your pipeline and costing you valuable time and resources.

Precision in accurate homeowner and seller information is paramount, allowing you to easily connect with genuine leads and close deals efficiently.

This is where advanced data validation and our proprietary process truly stand out.

While other platforms might offer data, we emphasiz high data accuracy via using multiple skip tracing tools. This isn’t just about pulling contact info; it involves running raw data through

multiple skip tracing tools available in the market to ensure data accuracy. This significantly improves your outreach success rate, minimizes wasted efforts, and directly addresses the difficulty finding high-quality, off-market/distressed leads with the best motivation.

How Our Data Stands Out & Helps You Find the Right Leads with the Best Motivation

We specialize in off market property deals, distress property data (probates, FSBOs, divorce properties, foreclosures, preforeclosures) that often leads to motivated sellers who are ready to make a deal urgently and open to negotiation.

Our data insights allow you to target prospects with a higher propensity to sell or a stronger motivation, ensuring you focus on genuinely interested individuals.

Multi-Source Data Aggregation

Unlike platforms that rely on a single data stream, we combine some of the most reliable skip tracing tools and provide

accurate and actionable real estate lead data. This comprehensive approach gives you a more complete view, helping you identify true opportunities.

Unmatched Skip Tracing Precision

Our commitment to Reliable Skip Tracing for Real Estate means we provide highly reliable contact information (phone numbers, emails) by cross-referencing results from multiple sophisticated platforms. This reduces your dead lead rate and puts you directly in touch with decision-makers.

Time and Cost Efficiency

By providing meticulously accurate and highly motivated leads, we save you immense time on manual research and wasted marketing spend. You can focus your efforts on prospects who are most likely to convert, maximizing your ROI and allowing you to

Are You Navigating Canada’s Evolving Real Estate Landscape Effectively?

Canada’s real estate market offers unique challenges and unparalleled opportunities, especially in the distressed property sector. Understanding foreclosure risk, coupled with strategic lead generation, accurate data, efficient workflow management, and targeted marketing, can unlock significant growth for your business.

At REI Data Solutions, our mission is to empower real estate professionals by offering informative insights, streamlining their workflow, and helping them achieve sustained business growth. We provide the accurate data, tools, and support you need to navigate these waters with confidence.

Are you ready to truly streamline your prospecting process and elevate your real estate business? Explore our data solutions and services today!

FAQs

1. What's the main way to identify potential foreclosure properties in Canada?

ince Canada doesn't have a national foreclosure registry, the most reliable way to spot future opportunities is by tracking mortgage delinquency rates in different provinces. A rise in these rates often signals homeowners struggling, making them potential motivated sellers

2. How exactly does a mortgage delinquency lead to a sale opportunity for me?

When a homeowner can't make their payments, the lender can initiate a "power of sale" or "court foreclosure." These legal processes force the sale of the property to cover the debt. This creates a situation where sellers are often highly motivated to make a quick deal, giving you an advantage in negotiations.

3. Which Canadian provinces should I focus on for 2025 distressed property leads?

Based on current trends, provinces like Ontario (especially the Toronto housing market) and British Columbia are showing rising mortgage delinquency rates. While Saskatchewan has a high rate, its trend is different, but still offers opportunities. Keeping an eye on Canadian mortgages news will help you track these shifts.

4. How can accurate data and virtual assistants help me find and close these deals faster?

Accurate data (including reliable skip tracing) gives you direct contact information for distressed property owners, saving you immense time. Virtual assistants can then handle the initial outreach, follow-ups, and administrative tasks, freeing you up to focus on closing deals and maximizing your ROI.