The phrase “eviction property” conjures images of legal headaches and difficult tenants.

But for the savvy real estate professional, these properties represent a unique and often overlooked path to building a truly profitable real estate portfolio.

Instead of seeing a liability, a smart investor sees a motivated seller and the potential to acquire a property significantly below market value.

This guide is designed for real estate professionals (REPs) who want to move beyond traditional listings and into a niche that rewards preparation and a proactive, data-driven approach.

We’ll explore the “why” behind this strategy, navigate the legal landscape, and provide actionable steps to find, analyze, and profit from eviction properties.

The Opportunity: Why Eviction Properties Can Be Profitable Real Estate

The foundation of any successful investment is identifying a motivated seller. In the case of eviction properties, a landlord is often facing a confluence of problems: a long, expensive, and emotionally draining legal process; lost rental income; and the potential for a damaged property.

For these sellers, a quick, fair cash offer from an investor is a welcome solution that can save them months of stress and thousands of dollars in legal fees.

This creates a significant advantage for the investor. While a traditional property sale might involve bidding wars and fierce competition, an eviction property often has a much smaller pool of interested buyers.

This allows you and your clients to negotiate a favorable price, maximizing the potential for a high ROI once the property is stabilized.

Navigating the Legal Landscape: A REP’s Guide to Eviction Services

The legal framework surrounding evictions is complex and varies significantly by state and even by city. A successful investment in this space requires a deep understanding of these regulations to ensure a smooth and ethical process.

One recent change to be aware of is in California, where a new law, Assembly Bill 2347, extends the length of time tenants have to respond to eviction notices from five to ten business days.

This change provides tenants with more time to seek legal counsel or negotiate payment plans, which can, in turn, prolong the eviction timeline for landlords. Changes like this underscore the importance of staying current on local laws.

This is where professional eviction services become invaluable. These third-party experts can help investors navigate the labyrinth of paperwork, court filings, and tenant communication, de-risking the entire process and ensuring all actions are compliant with the law.

In Phoenix, Arizona, landlords filed a record-breaking 86,946 evictions in 2024, corresponding to an eviction filing rate of 14.3%—that’s nearly one in seven renter households, or roughly one eviction filing every six minutes.

Pro Tips:

Pro Tips:

- Become the go-to expert in one area, like luxury homes, commercial properties, or first-time buyer units.

- Cultivate relationships with other agents, contractors, and lenders to get early access to off-market deals.

- The market, laws, and technology are constantly changing; stay current to maintain a competitive edge.

- Negotiation is about listening, understanding the other party’s motivation, and focusing on a win-win outcome.

- Use technology for lead generation, property analysis, and client communication to save time and scale your business.

Finding & Vetting Eviction Properties: A Data-Driven Approach

While some eviction properties may appear on traditional listings, the most lucrative opportunities are found off-market. A staggering 70% of eviction properties are sold off-market, making it a goldmine for investors with the right tools.

Instead of manually sifting through court records and public databases—a time-consuming and often inefficient process—the modern REP uses a data-driven approach. Many platforms automate the process of finding and analyzing these properties, providing you with a constant stream of high-potential leads.

These services allow you to filter by specific criteria, such as location, eviction status, and property type, to quickly identify the most promising investment opportunities.

Creating a Strategic Plan for Profitable Real Estate

Once a promising property is identified, the next step is to create a comprehensive investment plan. This is where you, as the REP, can provide critical value to your client.

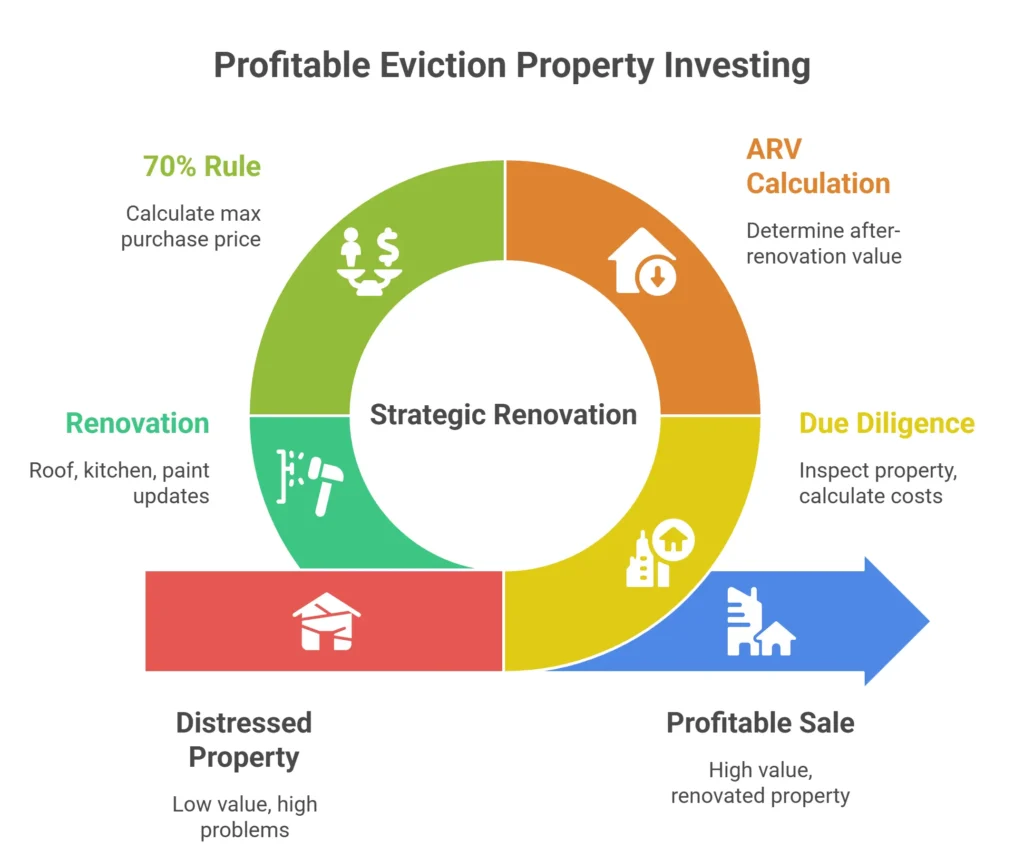

Due Diligence & Financial Assessment

Before making an offer, a thorough financial assessment is non-negotiable. This involves:

Inspecting the Property

Eviction properties can sometimes suffer from intentional damage. A detailed inspection will reveal the true extent of needed repairs.

Calculating all Costs

Beyond the acquisition price, account for all potential expenses, including renovation, holding costs (taxes, utilities), and closing costs.

Determining After Repair Value (ARV)

The ARV is the estimated value of the property after all repairs are completed. A common calculation is to find comparable properties (comps) that have recently sold in a renovated state.

ARV Calculation

You can use a simple formula to determine the ARV. For example, if you find a comparable renovated property that sold for $350,000, and a detailed inspection reveals that your target property needs $50,000 in repairs to reach a similar condition, your ARV would be $400,000.

70% Rule

A popular guideline for investors is the “70% Rule,” which states that a property should be purchased for no more than 70% of its ARV, minus the cost of repairs. This provides a clear path to profitability. For example, with an ARV of $400,000 and $50,000 in repairs, the maximum you should pay is: ($400,000 x 0.70) – $50,000 = $230,000.

The Post-Acquisition Strategy

A Hypothetical Case Study With a solid financial plan in place, you can help your client choose their exit strategy. Let’s imagine a before-and-after scenario:

Before

A single-family home is purchased for $150,000 in cash. It is in distressed condition, with an ongoing eviction proceeding, a leaky roof, and an outdated interior. The ARV is estimated at $250,000.

After

After a smooth transition assisted by eviction services, the investor spends $40,000 on renovations, including a new roof, kitchen updates, and fresh paint. The total investment is $190,000. The property is then sold for its full ARV of $250,000, generating a gross profit of $60,000. After accounting for closing costs, this could result in a net profit of over $40,000.

FAQs

Q: Can I just buy a property and evict the tenant myself?

A: In most cases, no. This is known as a "self-help" eviction and is illegal in nearly all jurisdictions. It can lead to severe penalties, including fines and lawsuits. The legal eviction process must be followed, and it's best to work with a professional.

Q: What if the tenant leaves personal belongings behind?

A: You must follow local and state laws regarding abandoned property. Many states require you to store the items for a specific period (e.g., 15-30 days) and provide the tenant with written notice of where and when they can retrieve them. You cannot simply throw away their possessions.

Q: Is it really more profitable to buy an eviction property?

A: Yes, it can be, but the potential for higher profit comes with greater risk and complexity. The profitability stems from acquiring the property at a discount due to the motivated seller and the lack of competition from traditional buyers. However, you must be prepared for the legal, financial, and logistical challenges involved.

Q: Can I lose money on an eviction property investment?

A: As with any investment, there is always risk. The most common ways investors lose money on these properties are by underestimating renovation costs, misjudging the timeline for eviction and repairs, or failing to follow legal procedures, which can lead to expensive lawsuits. Thorough due diligence is key to mitigating these risks.

Conclusion

Investing in eviction properties is not for the faint of heart, but with the right knowledge and tools, it can be a highly profitable real estate strategy. It’s a niche that rewards preparation and a proactive approach, allowing you to bypass the traditional market and find deals that are often invisible to the average investor.

By understanding the legal landscape, leveraging powerful data solutions, and creating a sound financial plan, you can guide your clients toward success in this specialized market.

Ready to find your next high-potential investment? Contact us today to learn how REI data Solutions can help you discover, analyze, and acquire your next profitable real estate opportunity.