Did you know that in 2023 alone, over $22 billion in property taxes went unpaid across the U.S.? That’s a massive, overlooked market just waiting to be tapped.

Smart real estate pros aren’t fighting over typical deals anymore.

They’re quietly building wealth with one simple idea: Problems can be opportunities.

Specifically, properties with unpaid taxes offer a powerful way to invest. You can get them for surprisingly little money, or earn passive income through interest, with rates in some states reaching up to 36% annually!

Plus, your investment is secure, backed by the property itself with top priority over other debts.

But first you need to find those tax delinquent homes and get in touch with the owner. That certainly takes some serious work and what’s the most effective places to look for?

What Makes Tax Delinquent Properties a Unique Investment Opportunity?

Understanding Tax Delinquent Properties

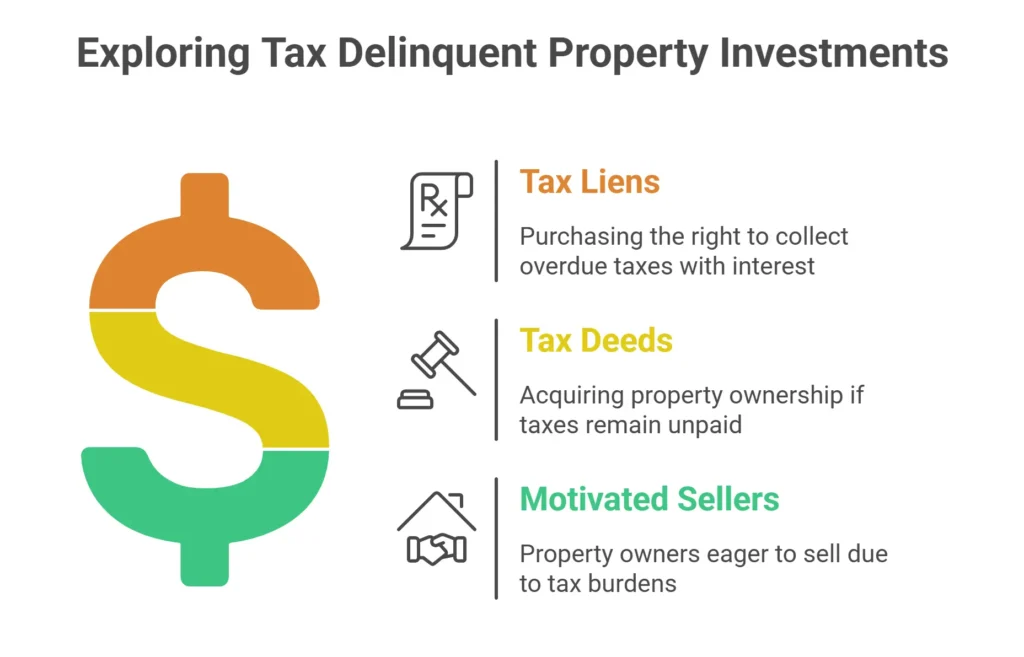

A property becomes tax delinquent when its owner fails to pay property taxes by a specified due date. This situation often presents two distinct investment pathways:

Tax Liens

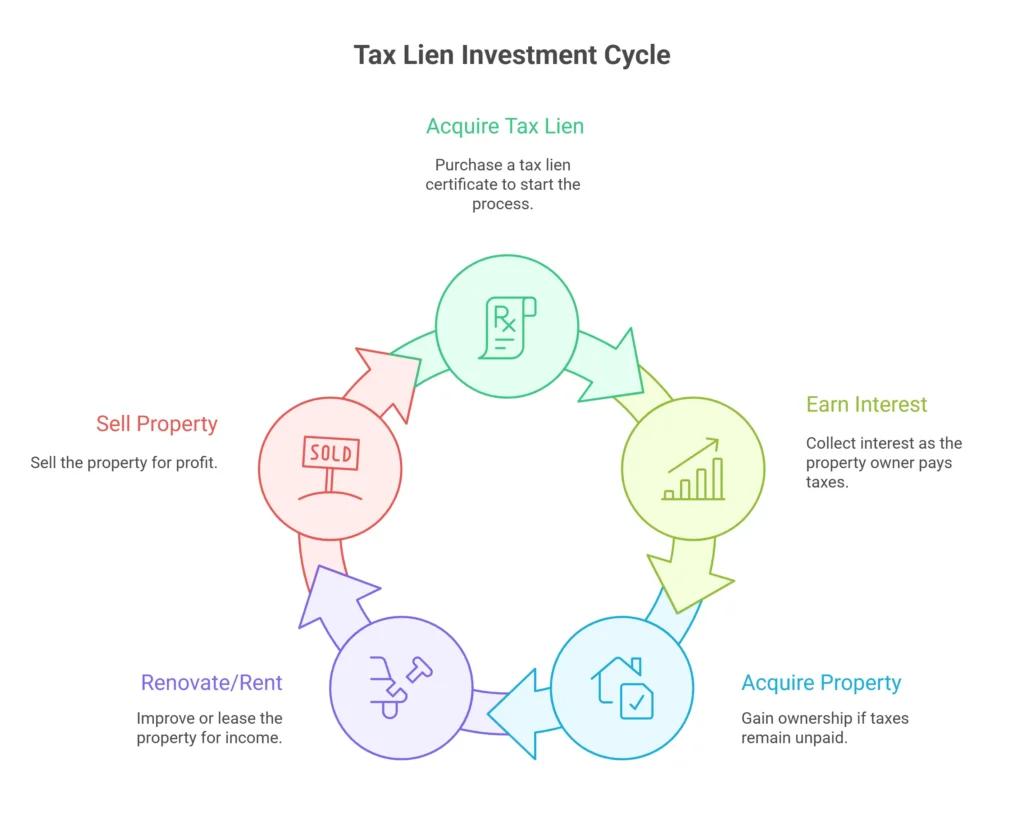

When an investor purchases a tax lien certificate, they are essentially acquiring the government’s right to collect the overdue taxes, often earning a high interest rate until the property owner redeems their property by paying the back taxes and interest.

Tax Deeds

If the property owner fails to redeem the tax lien within a specific, legally defined period, the investor may gain the right to acquire the property itself through a tax deed sale.

Property owners facing tax delinquency are typically motivated sellers who are ready to make a deal urgently and open to negotiation.

This motivation stems from their immediate need to resolve their tax burden, creating a fertile ground for mutually beneficial transactions.

Why Do These Properties Offer High Potential?

Investing in tax delinquent properties can offer substantial advantages for discerning real estate professionals:

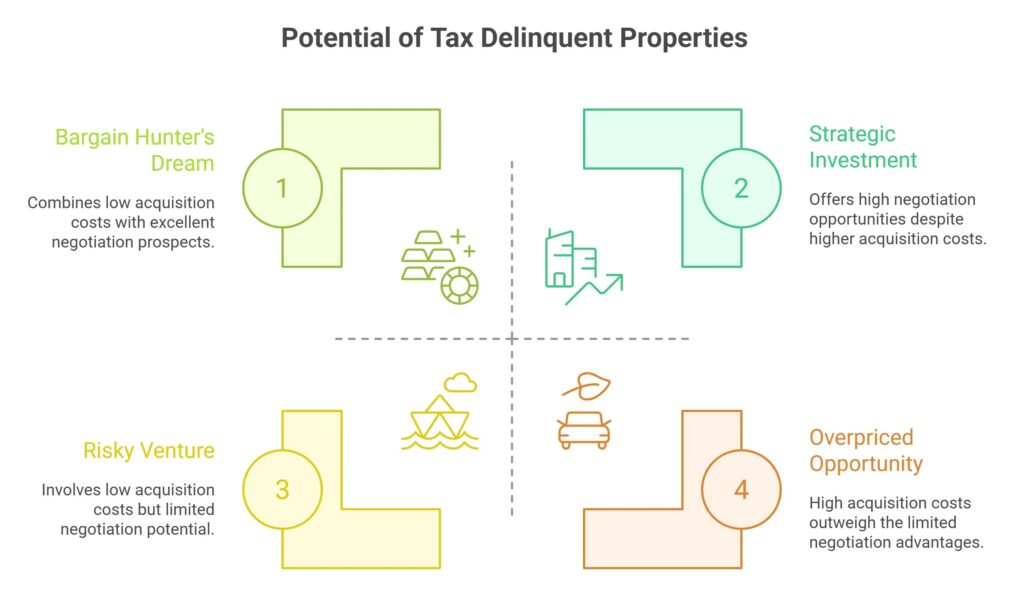

Lower Acquisition Costs

These properties are frequently available lower than market value, presenting an immediate equity advantage for investors.

Enhanced Negotiation Opportunities

The distressed nature of these properties often leads to better negotiation opportunities, which directly translates into excellent flip and sale opportunities.

Portfolio Diversification

Adding tax delinquent properties to an investment portfolio can provide a unique form of diversification and open pathways to high returns, complementing other real estate strategies.

How Do Investors Typically Find Tax Delinquent Properties?

Traditional and DIY Methods

Historically, investors have relied on a few common methods to identify tax delinquent properties:

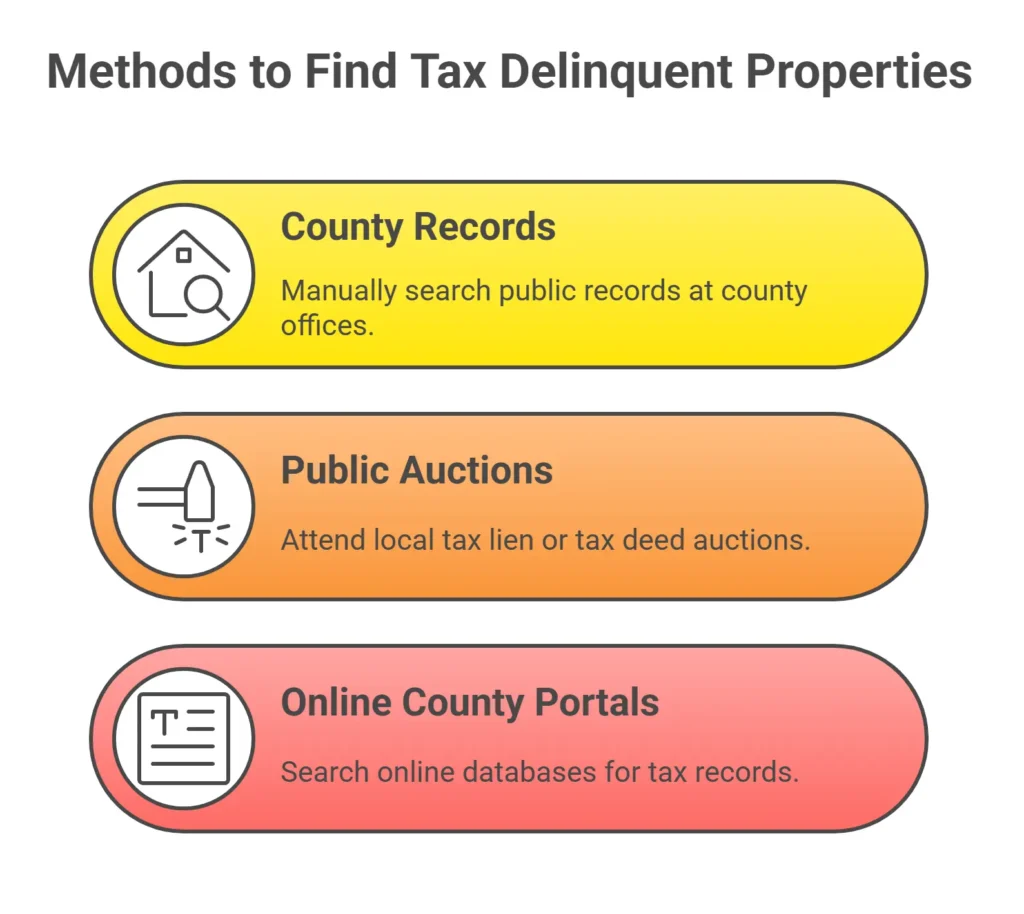

County Records

A classic approach involves visiting county tax assessor or treasurer offices to manually search public records for lists of delinquent properties. This can be a detailed, line-by-line review of physical documents.

Public Auctions

Attending local tax lien or tax deed auctions, often publicized by counties, serves as another traditional method for acquiring these properties or their corresponding liens. This requires active participation and real-time decision-making.

Online County Portals

With digitalization, some counties now offer online databases for tax records. While more accessible than in-person visits, these still require manual searching, compilation, and often, significant data entry.

What Are the Challenges of Manual Lead Generation?

While these traditional methods can yield results, they come with notable inefficiencies:

Time and Resource Intensive

These manual methods are incredibly time-consuming and demand significant resources, diverting valuable attention from core business activities.

Data Accuracy Issues

Public records can sometimes be outdated or incomplete, making it difficult to easily connect with genuine leads. Finding accurate phone numbers for direct outreach are often challenging with raw, unverified data.

Limited Scale and Reach

Relying on manual searches severely limits the volume and reach of potential leads an investor can pursue, directly impeding the ability to scale operations and achieve significant business growth.

How Can You Efficiently Access High-Quality Tax Delinquent Leads?

The Power of Targeted Lead Data

To overcome the inherent challenges of traditional lead generation, real estate professionals can revolutionize their prospecting strategy with our data-driven solutions.

REI Data Solutions provides accurate, targeted lead data, including vetted, bulk lead data for FSBOs, foreclosures, probates, divorce properties, absentee owners, and more.

This directly includes tax delinquent properties as a key category of distress property data specifically curated for motivated sellers.

REI Data Solutions has established itself as a trusted provider of real estate data, distinguished by an unmatched ability to harvest information from 40+ BILLION public records and proprietary data sources.

Ensuring Data Accuracy and Actionability

A critical unique selling proposition (USP) for REI Data Solutions is its commitment to high data accuracy via using multiple skip tracing tools.

The data is meticulously run through multiple skip tracing tools available in the market to ensure data accuracy. This rigorous process helps you easily connect with genuine leads and close deals.

The focus is unequivocally on the quality of the information we provide, not just the volume, ensuring you receive REAL information so you can grow your business.

With this accurate and actionable data, you can effectively prospect leads through proven methods like cold calling and direct mailing, confident in the integrity of your outreach.

Pro Tips:

Pro Tips:

- Verify property and lien details carefully—public records can be complex.

- Understand local tax sale rules—they vary by county and city.

- Know your profit strategy before buying a lien or deed for best ROI.

What Strategies Help Turn Tax Liens into Profits?

Understanding Profit Mechanisms

Investing in tax liens and deeds offers clear avenues for profitability:

Interest Earnings from Liens

If you acquire a tax lien certificate, your primary profit mechanism comes from the interest earned. The property owner must pay the delinquent taxes plus interest to redeem their property, providing a reliable return on your initial investment.

Acquisition Through Deeds

Should the property not be redeemed within the statutory period, you may gain ownership of the property through a tax deed. This direct acquisition allows you to then renovate and flip for sale, or hold the property for consistent rental income, maximizing its long-term value.

Leveraging Vetted Leads for Strategic Deals

High-quality, vetted leads are paramount for strategic investment in tax delinquent properties. They allow investors to quickly identify properties with the greatest potential for profit, whether through high interest yields on liens or valuable property acquisition through deeds.

Access to detailed, accurate lead data provides significant leverage for better negotiation opportunities and facilitates closing deals more efficiently and profitably.

FAQs

What are the key advantages of investing in tax delinquent properties over traditional listings?

Investing in tax delinquent properties offers significant benefits, including the potential for lower than market value acquisition, which provides immediate equity. These properties also present better negotiation opportunities due to the owner's urgent need to resolve their tax burden, leading to excellent flip and sale opportunities. They directly address the pain point of difficulty finding high-quality, off-market/distressed leads

How can Virtual Assistants help with tax delinquent property investing?

Virtual Assistants can significantly streamline your operations by managing crucial tasks such as lead data entry and organization, tracking offers and contracts, performing phone, SMS, and email outreach, handling customer support, and assisting with lead follow-up and appointment setting.

How does REI Data Solutions ensure the accuracy of its lead data?

They achieve high data accuracy by running data through multiple skip tracing tools available in the market to ensure data accuracy.

Can I try REI Data Solutions' services before committing?

Yes, you can get started with a 7-day free trial that offers full access to premium features without requiring credit card information.

What makes REI Data Solutions unique compared to other lead providers?

REI Data Solutions is unique due to its specialization in real estate data, focus on off-market/distressed property leads, high data accuracy via using multiple skip tracing tools, providing tailored solutions, and VAs who are experienced in real estate procedures

What types of distressed property leads does REI Data Solutions provide?

REI Data Solutions provides vetted, bulk lead data for various distressed properties, including FSBOs, foreclosures, probates, divorce properties, absentee owners, and specifically tax delinquent properties.

Conclusion

Investing in tax delinquent properties can be a highly lucrative venture, offering significant profit potential. However, identifying and acting on these opportunities demands precise, timely information and efficient operational support.

By leveraging targeted lead data and comprehensive support services, you can streamline your prospecting, acquire valuable distressed properties, and confidently turn liens into profits.

Ready to scale your deals faster? Revolutionize Your prospecting strategy with our Data-Driven Solutions today!