A fire damaged property presents a unique challenge that goes beyond a standard transaction.

While these properties can be profitable, they come with a significant legal and ethical obligation for brokers and agents.

This guide will walk you through the essential responsibilities of a broker when handling fire-damaged listings.

We’ll demystify the legal and ethical landscape, provide a framework for transparent documentation, and outline a strategic approach to valuation and marketing.

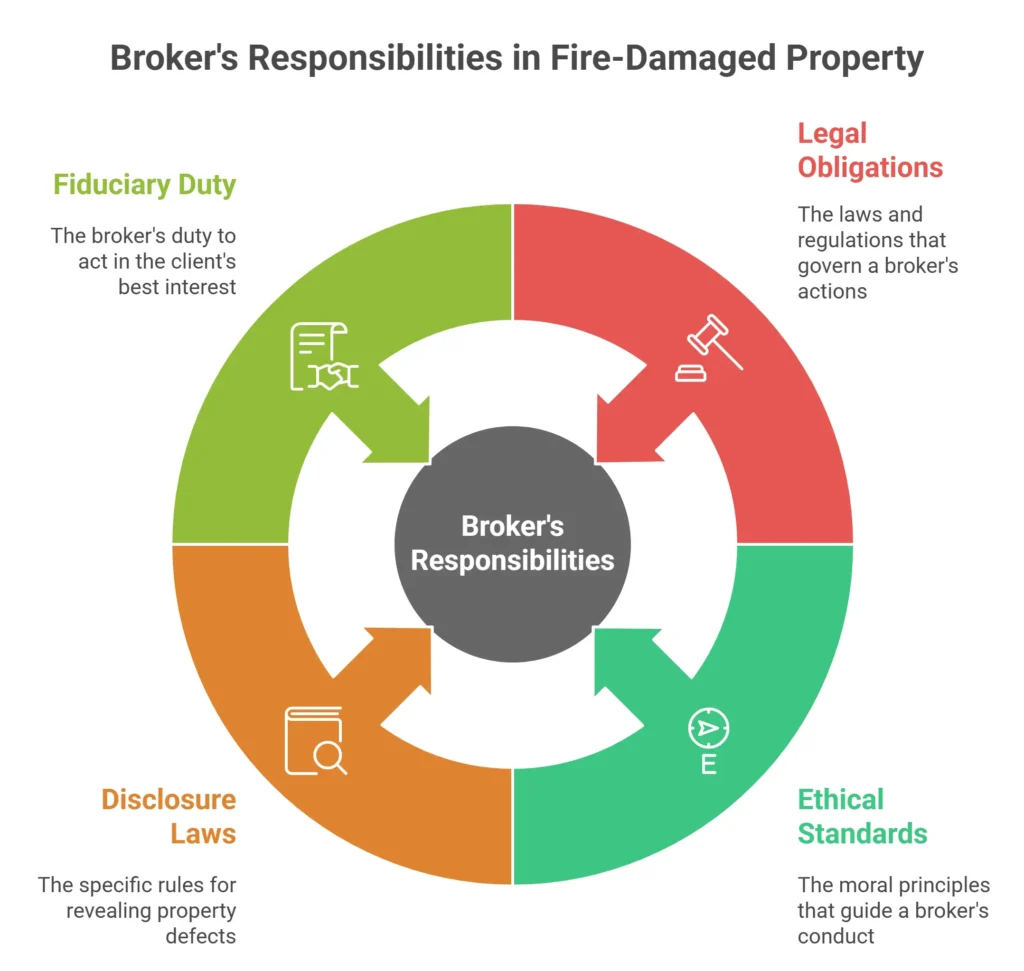

Legal and Ethical Obligations

As a broker, your responsibility is paramount when handling a house damaged by fire. Your duties extend beyond your client and are governed by state and federal laws, as well as a strict code of ethics.

The Duty to Disclose Material Defects

A broker responsibility is to disclose any material defects they are aware of, regardless of the seller’s wishes. A material defect is anything a reasonable person would consider important in deciding whether to buy a property. This includes:

- Structural damage from the fire itself.

- Smoke damage and the pervasive odor that can linger in materials and HVAC systems.

- Water damage from firefighting efforts, which can lead to mold and rot.

Even if these issues have been seemingly repaired, they must be disclosed. The mere history of the damage can be a material fact to a buyer.

State and Local Disclosure Laws

Disclosure laws are not universal. They vary significantly by state and sometimes by municipality. As a broker, you must be intimately familiar with the specific disclosure forms and legal requirements in your operating area.

The laws for a house damaged by fire often have special provisions, and a failure to follow them can put you at severe risk.

Broker’s Fiduciary Duty

While a broker owes a fiduciary duty to the client (the seller), this does not override the legal obligation to disclose known facts to a potential buyer.

A broker who misleads a buyer to secure a sale is not only acting unethically but is also exposing themselves and their client to serious legal consequences.

Strategic Pricing and Valuation

A key part of your role is to help the seller set a realistic and competitive price. The property’s unique condition requires a strategic approach to valuation and marketing.

Pricing the Home Appropriately

Fire damage inevitably lowers a property’s market value, making it crucial to price it appropriately. Overpricing a house damaged by fire can deter potential buyers, while underpricing leaves money on the table.

To overcome this challenge, you should work with appraisers experienced in distressed properties. They can help you determine the right asking price based on:

- The true extent of the damage.

- The condition of the surrounding neighborhood.

- Current market trends for similar properties.

Overcoming Buyer Concerns

Potential buyers will have concerns about the safety and long-term livability of a fire damaged home. Your job is to proactively address these concerns with clear, verifiable information.

- Provide Documentation: Share reports from fire marshals and structural engineers showing the property is structurally sound and safe.

- Highlight Positives: Emphasize features that remain unaffected, such as the location, lot size, or any recent renovations in a separate part of the house.

- Offer Solutions: Provide estimates for repairs or documentation of completed fire damage repair work to show buyers the costs of fixing the damage.

The Disclosure Process: Documentation and Transparency

Transparency is your best defense against future legal issues and is the cornerstone of brokers responsibility.

Compiling Essential Documents

Your first step is to compile a comprehensive disclosure packet. This goes far beyond the standard disclosure form. You must gather and organize:

- Official fire marshal or fire department reports.

- Records of insurance claims and payouts.

- Permits for all fire damage repair work.

- Receipts and invoices from licensed contractors who performed the fire damage and restoration.

- Professional inspection reports from structural engineers or mold remediation specialists.

Building Trust Through Transparency

Be honest about the property’s condition. Buyers will conduct inspections, so hiding the damage is not only unethical but can lead to a lawsuit down the line.

By providing a comprehensive disclosure packet upfront, you build trust and help buyers feel they are making an informed decision about the fire-damaged property.

Marketing the Fire-Damaged Listing Effectively

Your marketing strategy for a fire-damaged home must be highly targeted and honest.

Finding the Right Buyers

Traditional homebuyers may be hesitant to purchase a house damaged by fire. Your audience should be a niche of buyers who specialize in distressed properties. This includes:

- Real estate investors: Buyers who renovate and resell properties.

- Cash buyers: Individuals or companies willing to purchase “as-is” properties for a quick transaction.

- House-flipping companies: Professionals who specialize in repairing and reselling damaged homes.

Targeting these buyers in your marketing efforts will make the process faster and more efficient.

Pro Tips:

Pro Tips:

- Gather fire reports, insurance claims, permits, and repair invoices before listing to protect yourself and the seller.

- Write property descriptions and use platforms specifically for investors and cash buyers who seek out distressed properties.

- Hire an appraiser specializing in fire-damaged properties to set a realistic, competitive price.

- Provide full transparency on all damages (including hidden ones) to build buyer trust and prevent legal issues.

A Targeted Marketing Approach

Use high-quality photos and descriptions that focus on the property’s potential while being transparent about its condition. Highlight factors like:

- The lot’s location and size.

- Investment opportunities for buyers who want to renovate.

- Unaffected areas of the home, such as a large backyard or a newly renovated kitchen.

Additionally, consider listing your property on platforms that cater to investors and cash buyers. This will ensure your fire-damaged homes for sale listings reach the right audience.

The Consequences and Risks of Non-Disclosure

Failing to be transparent about a fire-damaged property can have severe and lasting consequences for a broker.

Legal and Financial Risks

A broker who fails to disclose known damage can be sued for misrepresentation, fraud, or negligence. This can result in substantial financial penalties, including legal fees and court-ordered damages that could far exceed your commission.

Professional and Reputational Damage

Non-disclosure can lead to disciplinary action from the state real estate commission, including fines, suspension, or even the revocation of your license.

A broker’s reputation is their most valuable asset, and a single lawsuit over a house damaged by fire can permanently damage it, making it difficult to attract future clients.

FAQs

What exactly is a "material defect" that must be disclosed for a fire-damaged property?

A "material defect" is any issue that could significantly impact the value or desirability of a home. For a house damaged by fire, this includes not only visible structural damage but also lingering smoke damage, mold from water, and any previous repairs, even if they appear complete.

Does disclosing fire damage scare away all potential buyers?

Not necessarily. While it may deter traditional buyers, it effectively targets the right audience: real estate investors and specialists who are looking for distressed properties. Transparency builds trust and helps you connect with buyers who are prepared for the work required.

What should a broker do if a seller refuses to disclose known fire damage?

A broker's legal and ethical duty to disclose overrides the seller's wishes. If a seller insists on non-disclosure, the broker must refuse the listing to avoid legal liability and potential license revocation.

What documentation is most crucial when selling a fire-damaged house?

The most critical documents are the fire marshal's report, all repair permits, and invoices from licensed contractors who performed the fire damage repair. Providing these documents upfront demonstrates transparency and reassures buyers.

Are brokers responsible for finding hidden damage they aren't aware of?

A broker is responsible for disclosing any material facts they know or should have known through reasonable diligence. While they are not expected to be building inspectors, they have a duty to investigate and ask the right questions to the seller and relevant authorities.

Conclusion

The disclosure process for a fire-damaged property is more than a legal formality—it’s a critical ethical responsibility.

Proactive and transparent disclosure is not just about avoiding legal trouble, but about building a reputation as a trustworthy, professional broker who handles even the most challenging listings with integrity.

By mastering the art of ethical disclosure, strategic marketing, and expert valuation, you can successfully sell a fire damaged home and build a lasting business on a foundation of trust.

Ready to find and ethically navigate these unique properties?

Access our specialized data solutions with exclusive fire-damaged home listings — and start serving your clients with confidence. Reach out now.