Foreclosure vs short sale: Confused which unlocks your next deal? You’re not alone.

Whether you’re an investor hunting off-market bargains, an agent guiding distressed sellers, or a broker leading a team – knowing this critical difference is your key to:

- Spotting hidden opportunities

- Closing more transactions

- Protecting clients’ futures

Let’s cut through the noise. Here’s your clear breakdown to master both scenarios with confidence.

What Exactly IS a Short Sale in Real Estate? Let’s Break It Down

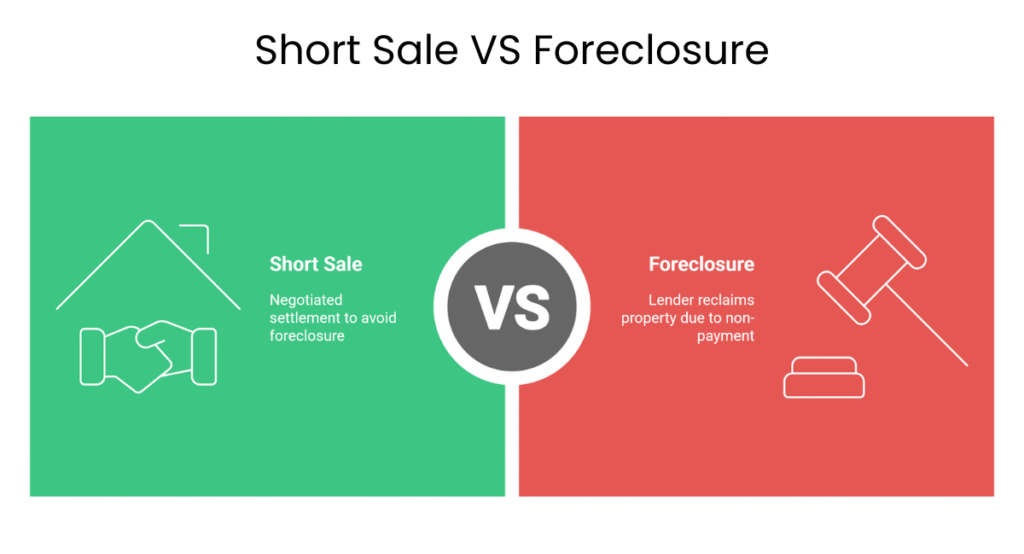

So, what is home short sale all about? A short sale occurs when a homeowner sells their property for less than the amount owed on the mortgage because they owe more than the home is worth.

Crucially, the lender must agree to accept this lower amount to settle the debt. It’s a way for both the homeowner and lender to avoid the more damaging process of foreclosure.

Essentially, the lender is weighing the cost of the “short” amount against the potentially higher costs and risks of foreclosing.

What is a Foreclosure? Understanding the Lender’s Last Resort

Now, let’s switch gears. What is a foreclosure? A foreclosure is a legal process in which a lender attempts to recover the balance of a loan from a borrower who has stopped making payments to the lender by forcing the sale of the asset used as the collateral for the loan (in this3 case, the house).

If a short sale is a negotiated settlement, what is a foreclosure can be seen as the lender exercising its right to reclaim the property due to a breach of the mortgage contract. It’s a more drastic measure and typically happens after other options, potentially including a short sale attempt, have failed or weren’t pursued.

The Path to Foreclosure: How Does It Happen?

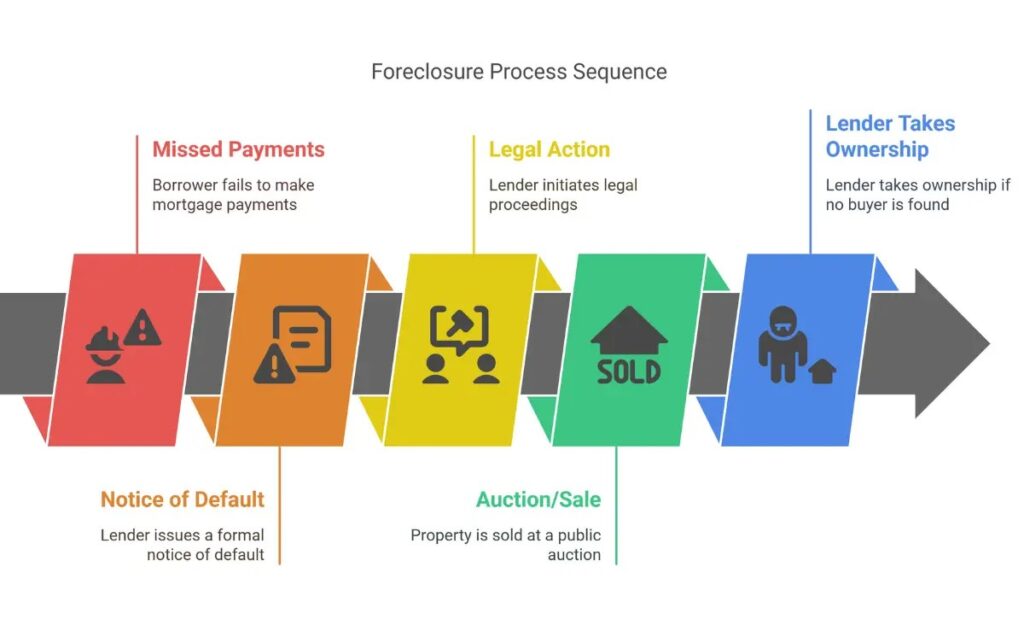

Foreclosure isn’t an overnight event. It’s a process that unfolds over time, usually starting with missed mortgage payments.

- Missed Payments: The borrower falls behind on their monthly mortgage obligations.

- Notice of Default: After a certain period of delinquency (often 90-120 days, but this varies by state and lender), the lender will issue a formal Notice of Default (NOD) or a similar notice, like a Lis Pendens. This is often public record – and a key piece of information for finding off-market leads!

- Legal Action: If the borrower doesn’t cure the default (pay the overdue amount), the lender initiates legal proceedings to terminate the borrower’s rights to the property.

- Auction/Sale: The process culminates in the property being sold at a public auction. If no third party buys it, the lender takes ownership, and it becomes an REO property.

Want the specifics? The timeline, types of foreclosure (judicial vs. non-judicial), and homeowner options vary. For a deeper look at each step, read our detailed foreclosure guide.

The Big Showdown: Foreclosure vs Short Sale – Spotting the Key Differences

Alright, now for the main event: the direct comparison. You’ve got the definitions, so let’s put foreclosure vs short sale head-to-head. Understanding these distinctions is critical whether you’re advising a seller, hunting for an investment, or just want to be the most knowledgeable pro in the room.

When clients ask, “Should I try for a short sale or foreclosure avoidance?” or when you’re evaluating a lead, these differences will guide your strategy. The short sale vs foreclosure debate has clear winners and losers depending on the circumstances.

Here are 7 key differences:

| Comparison Point | Short Sale | Foreclosure |

|---|---|---|

| Who Initiates? | Homeowner voluntarily starts process | Lender forces process after default |

| Lender Approval | Required – defines the short sale | Not required – lender exercises legal right |

| Credit Impact | Less damage (shorter recovery) | Severe damage (100+ pts; 7+ years on report) |

| Process Timeline | Longer (months–year+ for approval) | Shorter (especially non-judicial) |

| Deficiency Judgment | Waiver often negotiable | Higher risk of lender pursuit |

| Property Condition | Usually better (owner-maintained) | Often worse (vacant/”as-is” property) |

| Future Homeownership | Shorter wait (2–4 years) | Longer wait (5–7+ years) |

Why Real Estate Pros Focus on Foreclosure & Short Sale Leads

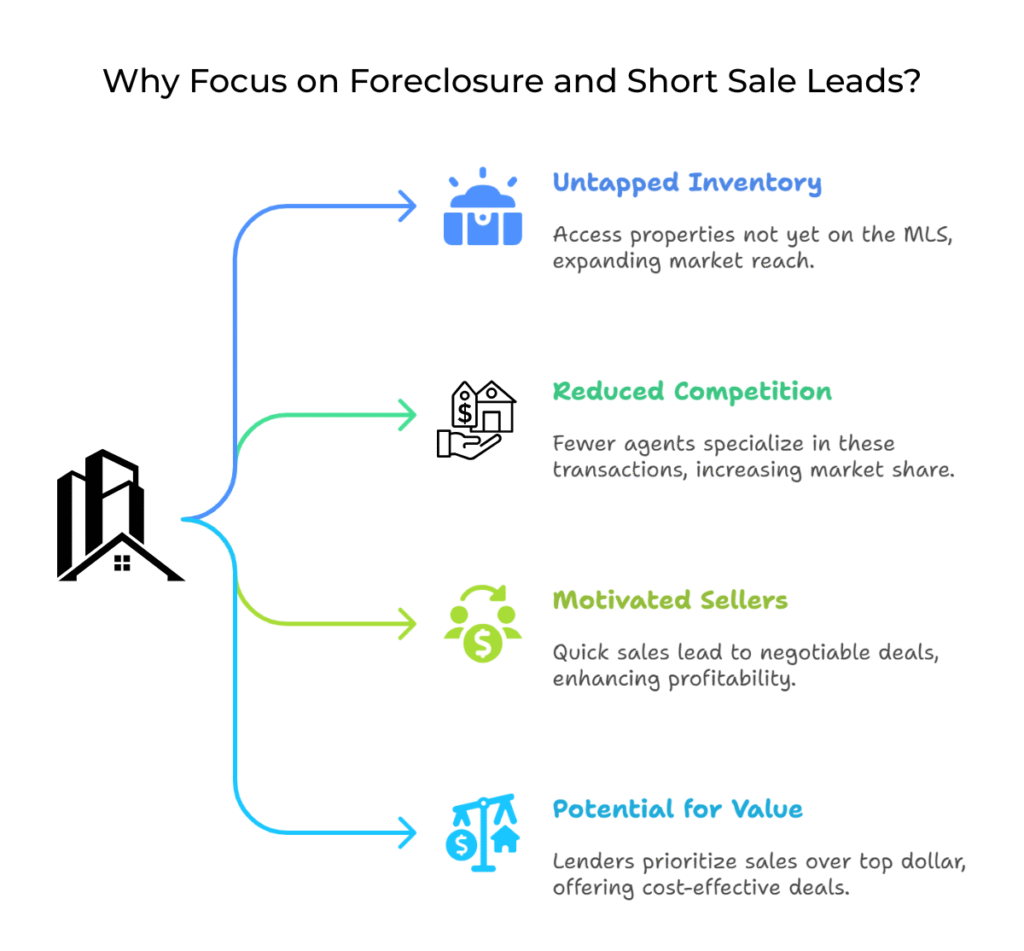

While challenging for homeowners, foreclosure and short sale situations offer significant opportunities for agents and investors. These off-market leads are valuable because they represent:

- Untapped Inventory: Many properties aren’t listed on the MLS yet.

- Reduced Competition: Fewer agents specialize in these complex transactions.

- Highly Motivated Sellers: Homeowners needing to sell quickly can lead to negotiable deals.

- Potential for Value: Lenders (in short sales) or banks (REO) may prioritize a sale over top dollar.

The Key: Finding Leads First

Success hinges on early access to reliable off-market data. Identifying homeowners in pre-foreclosure (after a Notice of Default) allows you to be among the first to offer solutions, like a short sale listing or a fair cash offer.

Understanding the detailed foreclosure process, timelines, and homeowner options is crucial for effectively pursuing these opportunities. Get the complete breakdown in our dedicated Foreclosure Process

Navigating the Nuances: Tips for Real Estate Professionals

Successfully navigating the waters of short sale in real estate and foreclosures requires more than just data; it requires strategy and empathy.

Setting Realistic Expectations for Your Clients (and Yourself!)

Whether you’re representing a seller in a short sale or a buyer interested in a distressed property, managing expectations is key.

For Sellers (Short Sale)

Explain that the process is long, lender approval is not guaranteed, and they’ll need to provide extensive financial documentation.

For Buyers

Help them understand that short sales can take months and foreclosure auctions have specific rules and risks (like buying sight unseen).

For Yourself

Don’t expect every lead to pan out. Persistence is crucial.

A client-centric approach that emphasizes transparency builds trust, even when the news isn’t what clients want to hear.

The Art of Negotiation in Short Sales and Foreclosures

Negotiation is a critical skill here.

Short Sales

You’ll be negotiating not just with the buyer, but critically with the seller’s lender (or multiple lenders). Be prepared, be persistent, and provide a well-documented short sale package. Highlighting the lender’s potential savings compared to foreclosure can be a strong tactic.

Foreclosures (Auctions/REOs)

At an auction, it’s about setting your maximum bid and sticking to it. When buying an REO from a lender, there’s often room for negotiation, but lenders are typically focused on net proceeds and quick sales.

Understanding the motivations of each party in the foreclosure vs short sale equation is vital for effective negotiation.

FAQs

Q1: Is a short sale always better than a foreclosure for a homeowner?

Generally, yes. A short sale typically has a less severe impact on credit, offers a greater sense of control over the sale process, and may allow the homeowner to avoid the stigma of foreclosure. It also provides an opportunity to negotiate a deficiency waiver. However, it requires significant effort and lender cooperation. The choice between short sale or foreclosure depends on the individual's circumstances and ability to navigate the short sale process.

Q2: Can I buy a short sale or foreclosed home with a regular mortgage?

Yes, in most cases. Buying a short sales home or an REO (bank-owned) property with a mortgage is common. However, lenders may have stricter underwriting criteria for financing distressed properties, especially if they need significant repairs. Buying directly at a foreclosure auction often requires cash or a specialized hard money loan due to the speed of the transaction.

Q3: What are the biggest risks when buying a short sale property?

The primary risks include:

- Time Delays: Lender approval for what is short sale mean in practice can take many months.

- Deal Falling Through: The lender might reject the offer, or the seller's financial situation might change.

- Property Condition: While often better than foreclosures, they are usually sold "as-is."

- Uncertainty: There's less certainty until the lender gives final approval.

Q4: How can I find reliable pre-foreclosure or potential short sale leads?

Finding these off-market leads can be done by researching public records, networking, or using specialized data services. While public records are a source, they can be time-consuming to sort through and the information may not be aggregated for easy use. Data providers often compile this information, offering curated lists that can save significant time and effort, focusing on data accuracy to help you connect with motivated sellers.

Q5: Do some companies provide data for both short sales and foreclosures?

Yes, many data service companies in the real estate sector, like REI Data Solutions, aim to provide comprehensive information. This often includes data on properties in various stages of distress, such as pre-foreclosures (which are prime candidates for short sales before an auction) and lists of REO properties (homes already foreclosed upon and owned by the lender). Access to such broad data helps professionals target opportunities across the spectrum of foreclosure vs short sale scenarios.

Q6: What’s a "deficiency waiver" in a short sale?

A deficiency waiver is an agreement from the lender that they will not pursue the homeowner for the remaining mortgage balance (the "deficiency") after the short sale closes. Getting this in writing is a crucial goal for any homeowner undergoing a short sale defined process, as it provides financial closure.

Q7: As an investor, which is typically a faster purchase: a short sale or a foreclosed home at auction?

A foreclosed home bought at auction is usually a much faster purchase – often closing within days or weeks, and typically requiring cash. A short sale vs foreclosure auction in terms of speed clearly favors the auction if successful. However, auctions come with their own risks (e.g., buying without inspection). Short sales are slower due to lender approval but may offer more time for due diligence. For more detailed information on the foreclosure process from a government perspective, you can visit resources like the Consumer Financial Protection Bureau (CFPB).

Conclusion

So, there you have it – a deep dive into the world of foreclosure vs short sale. As you can see, while both involve homes in financial distress, they are distinctly different paths with unique implications for homeowners, buyers, and you, the real estate professional.

Understanding what is a short sale means recognizing an opportunity for a negotiated, lender-approved sale below the mortgage balance. Understanding what is foreclosure means grasping the legal process where a lender reclaims a property.

For the go-getters in real estate, these aren’t just terms; they’re signals. Signals of motivated sellers, potential off-market deals, and chances to provide real solutions and value. The key is to approach these situations with knowledge, empathy, and the right tools and resources.