Savvy real estate pros don’t run from distressed properties—they run toward them.

Why? Because when done right, investing in a distressed home can mean bigger profits, faster closings, and less competition.

But high rewards come with high risks. Legal headaches, surprise repairs, and tough financing can quickly eat into your ROI.

This guide breaks down the real pros and cons—so you can invest smart, not scared.

Key Takeaway

- Distressed properties offer high potential profit through lower acquisition costs and negotiation opportunities, especially with motivated sellers.

- Investing comes with significant risks including unforeseen repair costs, financing challenges, and potential legal complications, requiring careful due diligence.

- Leveraging accurate, data-driven insights is crucial for identifying viable deals and mitigating risks in this market.

- Accessing specialized off-market distressed leads and utilizing real estate-experienced support services can streamline the investment process and save valuable time.

The Allure of Distressed Properties: Why They’re Like a Super Deal?

Imagine finding a cool vintage toy for a really low price at a garage sale, fixing it up, and then selling it for a lot more money. That’s kind of what investing in distressed properties can be like! Here’s why investors get so excited about them:

Lower Price Tags!

One of the biggest reasons people love distressed properties is that they often come with a much lower price tag than other homes. Think of it: if a house needs a lot of work or its owner needs to sell it fast, they’re usually willing to accept less money. This means you can buy it for a bargain!

Amazing Negotiation Opportunities!

When someone is eager to sell their distressed property (maybe they’re moving, or they’re having money problems), they’re usually more open to talking about the price.

This means investors have a better chance to negotiate and get an even better deal. It’s like haggling for that cool toy at the garage sale – you can often get it for less than the sticker price!

Big Money-Making Potential!

This is where the magic happens! If you buy a distressed property for a low price, fix it up, and make it look amazing, you can then sell it for a lot more money. This difference between what you paid and what you sell it for is your return on investment (ROI) – basically, how much profit you make!

Many investors make excellent profits by flipping these kinds of homes.

Less Competition (Sometimes!)

Imagine a popular video game that everyone wants. It’s hard to get your hands on it, right? Most homes for sale are like that – lots of buyers competing. But some distressed properties aren’t even advertised in the usual places (like on popular real estate websites). Finding these “off-market” deals can mean fewer people are trying to buy them, which is a big advantage for smart investors.

Navigating the Pitfalls: Watch Out for Traps!

While distressed properties offer exciting possibilities, they also come with their own set of challenges. It’s important to be prepared for these “traps” so your treasure hunt doesn’t turn into a scary maze!

Hidden and Costly Fixes!

This is a big one! A distressed property might look like it just needs a fresh coat of paint, but underneath, there could be huge problems. Think leaky roofs, broken heating systems, or even structural issues.

These hidden repairs can cost a lot of money and gobble up your profits if you’re not careful. It’s like buying a used car that looks great on the outside, but the engine is totally messed up!

Tricky Financing!

Getting a regular home loan (called a mortgage) for a distressed property can be tough because banks don’t always like lending money for houses that need a lot of work. This means investors might need special loans with higher interest rates and fees, which can add to the overall cost.

Legal Headaches!

Sometimes, distressed properties come with complicated legal issues. There might be old debts on the property, or legal disputes between previous owners.

Sorting these out can take a lot of time and money, and you might even need a lawyer to help. It’s like trying to solve a super complicated puzzle with missing pieces!

Lots of Time and Hard Work!

Fixing up a distressed property is not a quick job. It takes a lot of time to plan the renovations, hire people to do the work (like plumbers and electricians), and make sure everything is done right. For busy investors, managing all this can be a real challenge.

Market Risks!

Imagine you’re fixing up a distressed property, and suddenly the real estate market changes. Maybe fewer people are buying homes, or prices start to drop. This could mean you sell your newly fixed-up home for less than you hoped, or it takes a long time to sell. It’s a risk you need to consider!

Strategies for Success: Treasure Map for Distressed Properties!

So, how do smart investors succeed with distressed properties and avoid those traps? Here are some super important strategies:

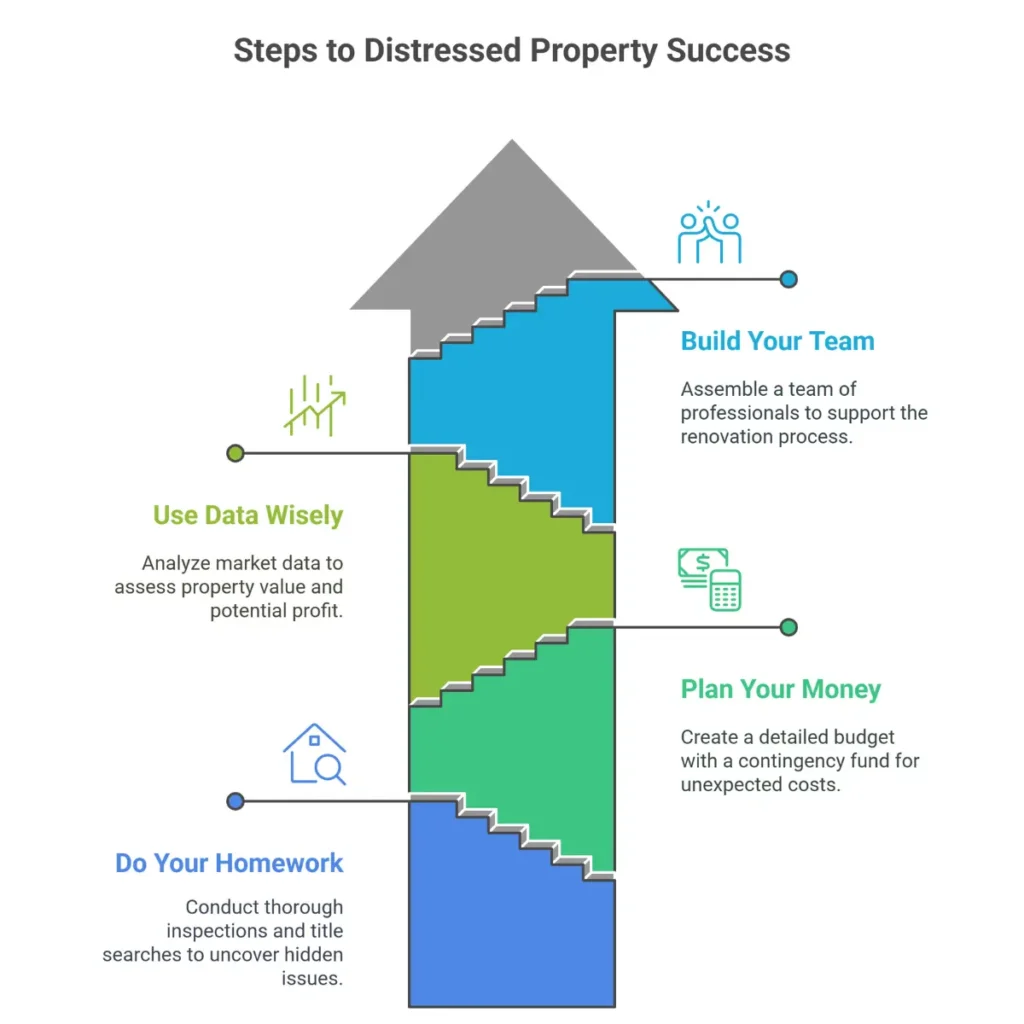

Become a Super Sleuth: Do Your Homework!

Before buying any distressed property, it’s super important to do your homework! This means getting a professional inspector to check every nook and cranny of the house for hidden problems.

You also need to do a “title search” to make sure there are no hidden legal issues or debts on the property. Being a good detective can save you a lot of trouble!

Be a Budgeting Boss: Plan Your Money!

Fixing up a distressed property costs money, so you need to be a budgeting boss! Make a detailed plan of all the repairs you think you’ll need, and then add extra money (called a “contingency fund”) for unexpected problems.

Also, remember to budget for things like taxes and insurance while you own the property.

Let Data Be Your Guide!

Smart investors use data to make their decisions. This means looking at information about the neighborhood, what other houses are selling for, and how much a fixed-up distressed property might be worth.

Using reliable data helps you figure out if a deal is truly a good opportunity and how much profit you can really make.

Build Your Dream Team!

You can’t do everything alone, especially with distressed properties! Build a team of trusted professionals: a good inspector, skilled contractors who know how to fix up old houses, a real estate agent who understands distressed sales, and maybe even a real estate lawyer. Having a strong team by your side makes the whole process much smoother.

Overcoming the Challenges: How to Make Distressed Property Investing Easier!

Even with all the challenges, there are ways to make investing in distressed properties simpler and more successful. Think of these as special tools for your treasure hunt!

Finding the Best Distressed Leads!

One of the trickiest parts of distressed properties is finding them in the first place, especially the ones that aren’t publicly listed. This is where specialized data services come in!

They can help you find motivated sellers who have properties that are “distressed” due to things like divorce, probate (when someone passes away), or financial difficulties. Using accurate data is key to connecting with the right people and finding those hidden gems.

Get Help and Save Time!

Real estate investing can take a lot of time, especially with all the phone calls, paperwork, and organizing. Many investors are super busy! But guess what?

You can get help! Services like Virtual Assistants (VAs) who specialize in real estate can handle tasks like calling leads, organizing information, and other administrative work. This frees up the investor’s time to focus on the big decisions and closing deals.

Smart Marketing for Your Finished Property!

Once you’ve transformed a distressed property into a beautiful home, you need to sell it! Effective marketing is super important to attract buyers or renters quickly. Digital marketing services can help you show off your amazing work online and find the perfect buyer for your renovated property.

FAQs

Q1: What kinds of problems make a property distressed?

A property can be distressed for many reasons! It could be in poor physical condition (needs a lot of repairs), or the owner might be facing financial problems (like not being able to pay their mortgage), or there could be legal issues like a divorce or probate.

Q2: Is investing in distressed properties only for rich people?

Not at all! While it helps to have some money for repairs, many investors start small. Some even find ways to invest without much of their own money, by partnering with others or getting special loans. The most important thing is knowledge and a smart strategy!

Q3: How do I find these off-market distressed properties?

This is a great question! Many investors use specialized data services that collect information on properties that are likely to be distressed, but not publicly listed. This can include properties in probate, properties going through foreclosure, or even properties where the owners have certain financial flags.

Q4: What's the biggest risk when buying a distressed property?

One of the biggest risks is uncovering unexpected and expensive repairs after you've bought the property. That's why thorough inspections are so, so important! Another risk is if the market changes and the value of your property drops before you can sell it.

Q5: What's an After Repair Value (ARV)?

ARV stands for After Repair Value. It's an estimate of what a distressed property will be worth after you've fixed it up and made all the necessary repairs. Smart investors use ARV to figure out if a deal will be profitable!

Q6: Can I really do this, even if I'm young?

Absolutely! Learning about real estate now gives you a huge head start. Many successful investors started learning young. While you might not be buying properties just yet, understanding these concepts is an amazing foundation for your future!

Conclusion: Your Distressed Property Journey!

So, there you have it! Investing in distressed properties is like an exciting adventure. It offers amazing potential for making money, but it also comes with its share of challenges. The key to success is being super prepared, doing your homework, making smart decisions with data, and building a great team around you.

Remember, every challenge has a solution! By learning how to find the best distressed leads, getting expert help to save time, and marketing your properties effectively, you can make your distressed property journey a really successful one.