Are you overlooking the simplest path to exponential profits?

With over $22 billion in unpaid property taxes (and potential returns reaching up to 24%), tax lien properties are a goldmine in real estate if…

…You know the insider strategies to convert them.

This is a unique landscape that promises to turn property liabilities into massive assets.

What are the key advantages of tax delinquent houses?

What Makes Tax Delinquent Properties a Unique Investment Opportunity?

For discerning real estate professionals, properties with delinquent taxes or existing tax liens offer an inherently appealing, less-trodden path to significant returns.

These opportunities frequently exist off-market, translating to substantially less competition compared to properties listed through traditional channels.

This distinct advantage allows investors to acquire assets often at a lower than market value, providing immediate equity and setting the stage for impressive profits.

The underlying motivation of the seller is key here. Owners facing tax delinquency are often highly motivated to sell urgently and open to negotiation, driven by the immediate need to resolve their tax burden.

This creates a fertile ground for mutually beneficial transactions, aligning perfectly with an ROI-focused investment approach.

Understanding Tax Delinquent Properties

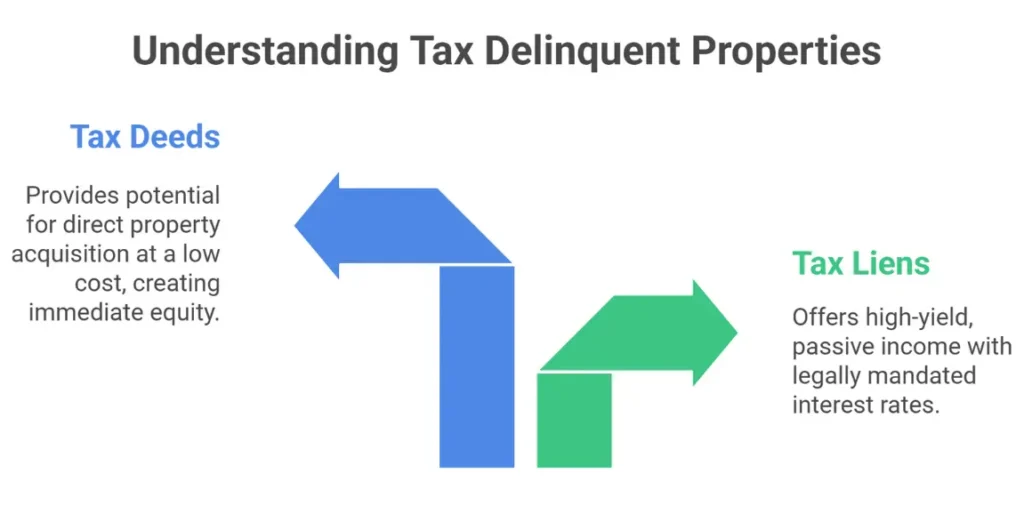

A property becomes tax delinquent when its owner fails to pay property taxes by a specified due date. This situation typically opens two distinct investment avenues:

Tax Liens

When an investor purchases a tax lien certificate, they are essentially acquiring the government’s right to collect the overdue taxes.

This typically involves paying the outstanding tax amount to the taxing authority.

The investor then earns a high interest rate (often legally mandated and significantly above market rates) on this investment until the property owner redeems their property by paying the back taxes plus the accrued interest.

This pathway offers a relatively passive, high-yield return.

Tax Deeds

If the property owner fails to redeem the tax lien within a specific, legally defined redemption period, the investor who holds the lien (or the highest bidder at a subsequent sale) may gain the right to acquire the property itself through a tax deed sale.

This direct acquisition means the investor could obtain the property for potentially only the cost of the back taxes and auction fees, creating immense equity from day one.

Pros and Cons of Tax Delinquent Property Investing

While the potential is significant, a balanced view is crucial for this specialized investment strategy:

Pros

- Lower Acquisition Costs: Properties are often available at a fraction of market value, providing immediate equity.

- Less Competition: Being off-market, these opportunities face fewer bidders than traditional listings.

- High Interest Returns (for Tax Liens): Tax lien certificates can yield impressive, legally mandated interest rates, offering a reliable, passive income stream.

- Motivated Sellers: Property owners facing delinquency are often desperate to sell, leading to favorable negotiation opportunities.

- Portfolio Diversification: Adds a unique, often uncorrelated, asset class to your investment portfolio.

- Clear Profit Pathways: Well-defined routes to returns, whether through interest earnings or direct property acquisition for flipping or renting.

Cons

- Legal Complexities & Jurisdictional Differences: Laws governing tax liens and deeds vary significantly by province/territory and even municipality in Canada, making a deep understanding of local regulations paramount.

- Redemption Periods: Property owners have a legally defined period to redeem the lien by paying back taxes and interest. If redeemed, the investor receives their principal plus interest, but not the property itself (for lien investments).

- Hidden Costs & Liens: Properties can come with existing mortgages, other liens (e.g., municipal utility liens, contractor liens, or even “super-priority liens” like certain government charges which can take precedence over tax liens), environmental issues, or code violations that become the investor’s responsibility upon acquisition.

- Property Condition Unknown: Physical inspection is often limited or impossible before acquisition, leading to potential unknowns regarding repair costs.

- No Profit if Redeemed (for Tax Deeds at Auction): If you bid at a tax deed auction, and the property is redeemed before the sale is finalized, you may simply get your money back without profit (though this varies by jurisdiction).

- Due Diligence Burden: The onus is heavily on the investor to conduct meticulous research to uncover all potential issues and liens.

The Investment Process: Best Practices for Acquisition and Beyond

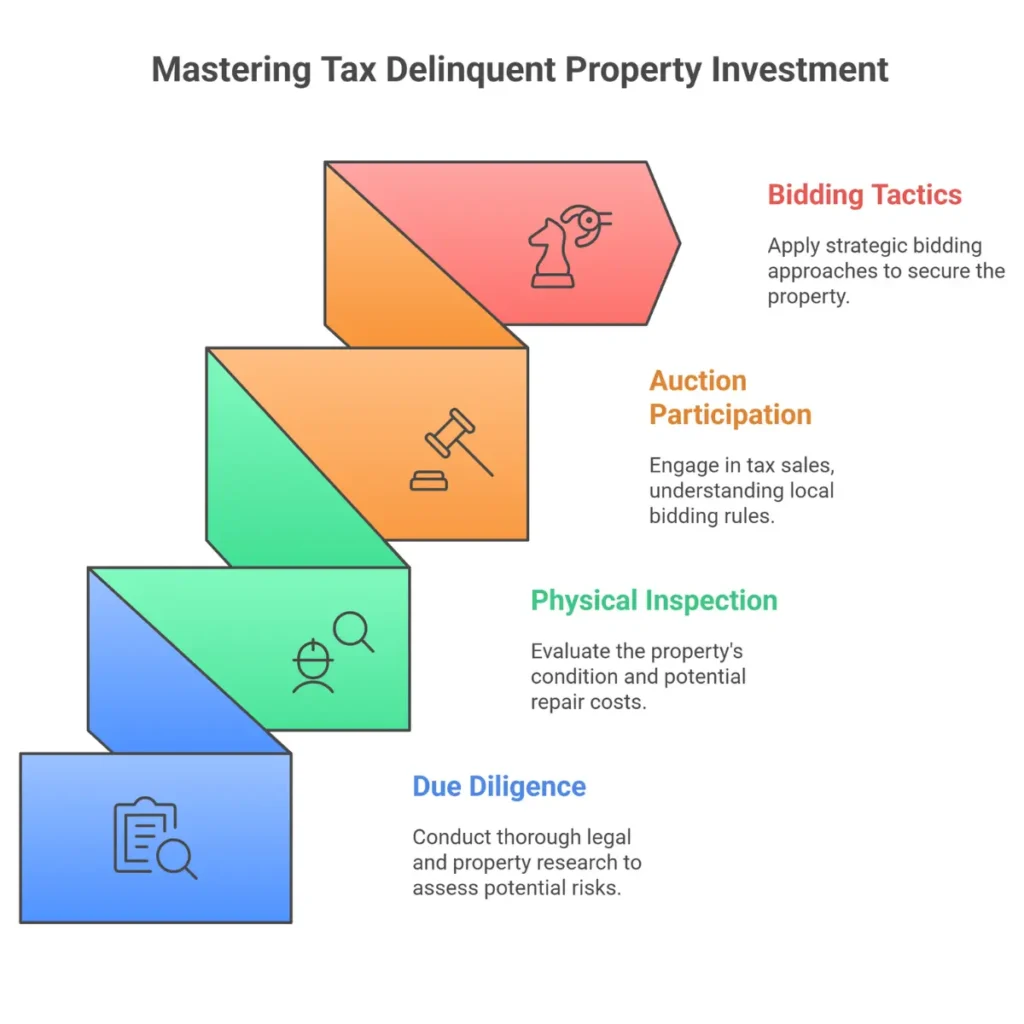

Mastering tax delinquent property investment extends far beyond simply finding a list. It demands a structured approach encompassing rigorous due diligence, strategic acquisition, and clear exit planning.

In-Depth Due Diligence on the Property and Title

Before even considering a bid or offer, comprehensive research is non-negotiable. This is where the “Difficulty finding high-quality, off-market/distressed leads” transitions into the equally challenging task of validating their true potential:

Legal Research & Title Search

This is paramount. You must uncover all existing mortgages, judgments, and other liens (e.g., utility liens, HOA fees, federal liens like CRA tax debts) that may attach to the property. Understanding lien priority (e.g., super-priority liens that could outrank your tax lien) is critical, as these could wipe out your investment if not properly accounted for.

Property Research: Investigate zoning regulations, potential code violations, environmental issues (e.g., contamination), and any outstanding permits.

Physical Inspection (If Possible)

While often difficult for tax-delinquent properties, attempting a drive-by or, if legally permissible, a more thorough inspection can reveal critical information about the property’s condition, potential repair costs, and habitability. This helps avoid costly surprises post-acquisition.

Acquisition Strategies: Participating in Tax Sales

The actual acquisition process typically involves participating in public tax sales:

Auction Formats

Sales can be conducted online or in-person. Each format has its own dynamics and demands different tactical approaches.

Bidding Tactics

Bid-Down Interest (for Tax Liens)

In some jurisdictions, bidders compete by offering the lowest interest rate they’re willing to accept on the tax lien certificate, with the lowest bid winning.

Premium Bidding (for Tax Deeds/Liens)

In other cases, bidders offer a premium above the outstanding tax amount, with the highest bid winning. Understanding the local bidding rules is crucial.

Pro Tips:

Pro Tips:

- Public records can be complex; verify all property and lien details before any commitment.

- Tax sale rules vary significantly by county and municipality – master the specific regulations in your target area.

- Identify your profit pathway (lien interest, flip, or long-term hold) before acquiring a tax lien or deed to ensure maximum ROI.

Understanding Legalities & Redemption Periods

The legal framework is the backbone of tax delinquent investing. As mentioned, laws vary widely by province/territory in Canada.

Redemption Periods

Each jurisdiction specifies a period during which the original property owner can “redeem” the property by paying the delinquent taxes, interest, and any associated fees to the tax lien holder. Understanding the length and specific conditions of this period is vital.

Importance of Provincial/Territorial Laws

You must be intimately familiar with the specific statutes governing tax sales in your target province/territory. Consulting with legal counsel specializing in real estate and tax law is highly recommended to navigate complexities and ensure compliance.

Exit Strategies: Maximizing Your Return

Once you’ve acquired a tax deed property, a well-defined exit strategy is crucial for realizing your profit:

Flipping

Renovating the property to enhance its value and quickly reselling it for a substantial profit. This is common for properties acquired at a deep discount.

Holding for Rental Income

If the property is habitable or can be made so with minimal investment, holding it as a rental property can provide a consistent stream of passive income.

Development

For prime locations or larger parcels, the highest and best use might involve redeveloping the property, either by tearing down the existing structure and building new, or by subdividing the land.

FAQs

What is a tax lien investment, and how does it work for real estate investors?

A tax lien investment involves purchasing a certificate that represents a claim on unpaid property taxes. Investors profit from the interest earned when the property owner redeems the tax lien, or potentially acquire the property through a tax deed if it's not redeemed.

How can I find reliable tax delinquent property lists for sale?

While traditional methods involve manual searches of county records, leveraging specialized services like REI Data Solutions provides vetted, accurate, and actionable tax delinquent property lists, along with other distressed property data.

Is investing in tax delinquent properties risky, and how can I mitigate those risks?

Like any investment, there are risks. You can mitigate operational risks by ensuring you have highly accurate lead data and contact information through advanced skip tracing, and by streamlining your outreach and administrative processes with efficient Virtual Assistant support. (Note: Always consult legal counsel for legal risks).

How long does it typically take to see a return from investing in tax delinquent properties?

The timeframe for returns can vary. For tax liens, profits are realized when the property owner redeems the lien (paying back taxes plus interest). If a property goes to a tax deed sale and is acquired, the return depends on your strategy (e.g., flipping, renting) and market conditions.

Can a virtual assistant help me manage my tax delinquent property investments?

Yes, Virtual Assistants can significantly streamline your process by handling tasks such as organizing large property lists, assisting with initial outreach (cold calling, direct mailing), performing lead follow-up and appointment setting, and managing your CRM and database for these specific leads.

Conclusion

Investing in tax delinquent properties presents a significant, often untapped, opportunity for real estate professionals seeking off-market deals and high-profit potential. However, identifying and acting on these opportunities demands not just a solid understanding of the investment process and its complexities, but also precise, timely information and efficient operational support.

This is where REI Data Solutions truly empowers your strategy. You can skip the time-consuming and often inaccurate work of manual tax lien lead collection.

We offer 99.9% accurate tax lien data and lead generation, coupled with robust skip tracing, ensuring you receive highly reliable contact information for those motivated sellers.

This unparalleled data accuracy and our commitment to providing actionable real estate lead data sets us apart from other platforms.

By partnering with us, you gain the confidence to connect directly with genuine leads, significantly improving your outreach success rate and allowing you to focus on what you do best closing deals and growing your portfolio.

Ready to scale your deals faster? Revolutionize Your Lead Generation Strategy with Our Data-Driven Solutions.