Tired of the endless competition for traditional real estate deals?

What if you could find a unique investment that offers high returns, low competition, and the potential to acquire property for pennies on the dollar?

Enter tax lien investment. While it’s a niche strategy, it has become increasingly popular, with many systems and courses promising high returns from tax yield investments.

This guide is designed for real estate professionals (REPs) who are exploring tax lien investing for beginners.

We’ll break down the key pros and cons, explain the process, and provide actionable tips to help you decide if this is the right path for your portfolio.

What Are Tax Liens? The Basics of a Government-Backed IOU

At its core, a tax lien is a legal claim a government entity (usually the county) places on a property when the owner fails to pay their property taxes.

When a homeowner becomes tax delinquent, the county sells the right to collect those back taxes—along with hefty interest and penalties—to a private investor.

This is the essence of tax liens investing. You’re not buying the property itself (at least not yet); you’re essentially buying the government’s right to collect the delinquent taxes.

Think of it as a government-backed IOU. The property itself serves as collateral. The investor who buys the tax lien certificate gets paid back by the homeowner, plus a significant, state-mandated interest rate.

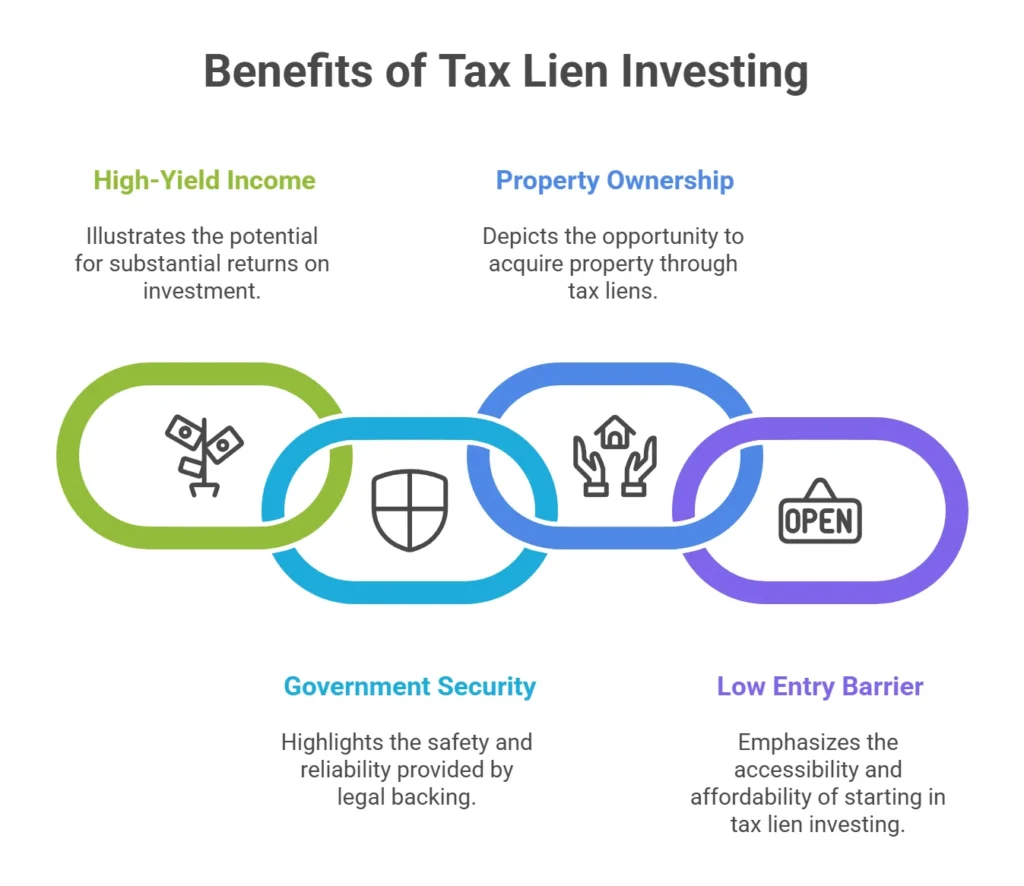

What are the pros of tax lien investing?

There’s a reason this strategy has gained so much attention. For the right investor, the pros can be incredibly appealing.

High-Yield, Passive Income

This is the primary draw for many investors. Many states offer very high, statutory interest rates on tax liens—sometimes as high as 12% to 36% annually.

When a homeowner pays their tax delinquency, you receive your initial investment plus the full interest earned. This makes tax yield investing a powerful source of passive income without the typical landlord headaches.

Government-Backed Security

Unlike many investments, a tax lien is backed by the government. The lien is a direct claim on the property, and it takes priority over almost all other liens, including mortgages. This security makes it a very low-risk investment if you do your due diligence.

Path to Property Ownership

If the homeowner fails to pay the debt during the state’s “redemption period,” you may have the right to foreclose on the property. This is how to acquire a property through a tax lien.

You could potentially become the owner of a house, land, or commercial building by paying just the back taxes and auction costs, which could be a fraction of the property’s market value. This is a common strategy for those who want to know how to purchase a tax lien property.

Low Barrier to Entry

The initial capital required to buy a tax lien certificate is often much lower than purchasing a full property, making it accessible to a wider range of investors.

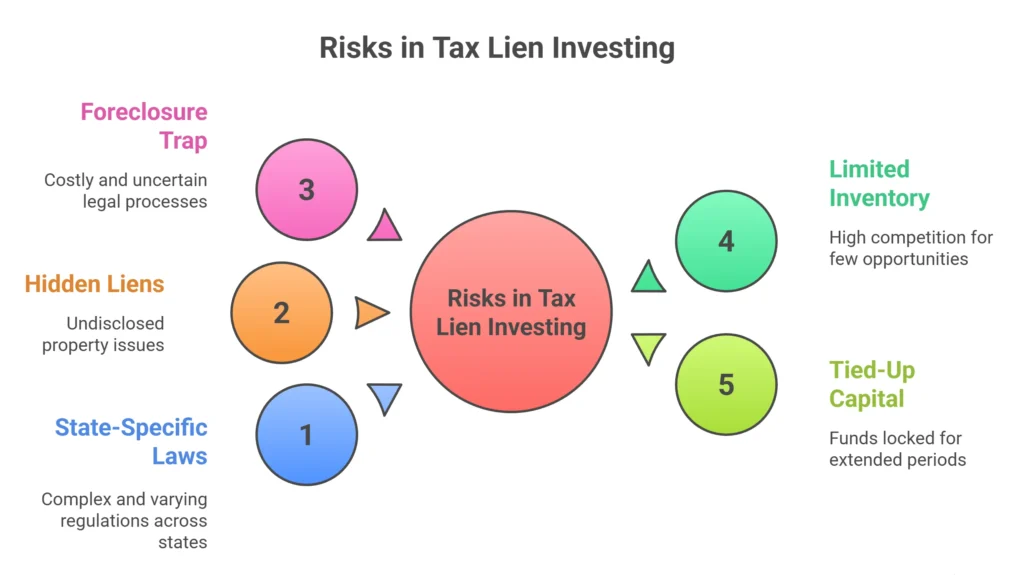

The Pitfalls: Cons and Risks of Tax Lien Investing

While the potential is high, a savvy investor knows to be just as aware of the risks. Tax lien investing is not a “get rich quick” scheme.

State-Specific, Complex Laws

There is no federal tax lien code. Every state has its own specific rules, which can vary wildly. Some states are “tax lien states,” where you buy the lien and the right to collect interest.

Others are “tax deed states,” where you bid directly on the property. Without a deep understanding of the local tax lien code, you could make a costly mistake.

Hidden Liens and Property Defects

While a tax lien takes priority, other liens—like an IRS lien—can exist. More importantly, when you buy a tax lien, you are doing so without a title search or a property inspection.

You could be buying a lien on a property with a ruined foundation, a contaminated site, or a burned-out shell. This is a major reason why due diligence is critical to how you buy a tax lien property successfully.

The Foreclosure Trap

The path to property ownership isn’t always smooth. The foreclosure process can be complex, expensive, and time-consuming. You may have to hire an attorney, pay legal fees, and navigate a lengthy court process, which can quickly eat into your profits.

The original owner can also still pay off the debt at the last minute, meaning you won’t get the property—just your principal and interest back.

Limited Inventory and High Competition

In many desirable states, the auctions for tax liens can be highly competitive. Professional investors, some of whom use specialized software, often bid down the interest rates, making the returns less attractive.

Tied-Up Capital

Your money is tied up for the entire redemption period (which can be 6 months to 3 years) with no income until the lien is redeemed.

How can real estate professionals navigate the risks?

For a savvy REP, success in this niche is all about doing your homework.

Do Your Homework

Before you bid on a single lien, thoroughly research the property. Look at its value, location, and potential issues. Use online tools to check for other liens and a physical drive-by to assess its condition.

Know the Code

Never invest in a state without a full understanding of its tax lien code. Work with a local attorney who specializes in tax sales to ensure you follow the process correctly.

Set a Bidding Limit

In an auction, it’s easy to get caught up in the moment. Know your maximum bid and stick to it, especially since overbidding can significantly reduce your returns.

FAQs

Q: Can I really get a property for "pennies on the dollar"?

A: This is a popular term, but it's not a guaranteed outcome. The opportunity to acquire a property for a fraction of its market value exists, but it is rare. In the vast majority of cases, the homeowner pays the taxes, and you simply receive your investment back with interest.

Q: What's the main difference between a tax lien and a tax deed?

A: A tax lien means you are buying the right to collect a debt, earning interest on the owner's unpaid taxes. A tax deed means you are buying the property itself, often through an auction, after the owner has failed to pay their taxes and the redemption period has expired.

Q: Is this a good investment for beginners?

A: While the barrier to entry can be low, the legal complexities and risks make it challenging for a true beginner. It is highly recommended to start with a small investment and work closely with a professional or expert mentor to learn the process.

Q: Can I lose money on a tax lien investment?

A: Yes. The most common ways to lose money are by failing to follow the correct legal procedures, underestimating the costs of a potential foreclosure, or investing in a property that has hidden issues or a lack of market value.

Conclusion

Tax lien investing offers a unique opportunity for real estate professionals to diversify their portfolios and explore a strategy with high-yield potential.

However, it is not a “get rich quick” scheme. The risks are real, and success depends on a meticulous, data-driven approach and a deep understanding of local laws.

Ready to take the next step in your tax lien investing journey? Contact us today to get started.