First time you heard about tax lien investing?

The idea of acquiring a property for just the back taxes is a powerful motivator.

But as a seasoned real estate professional, you know that the “get rich quick” stories are often oversimplified.

The real value, the true potential, lies far beyond the basics.

This guide is for you. We’ll move past the beginner-level concepts and dive deep into advanced due diligence, strategic exit planning, and the legal complexities that separate the pros from the amateurs

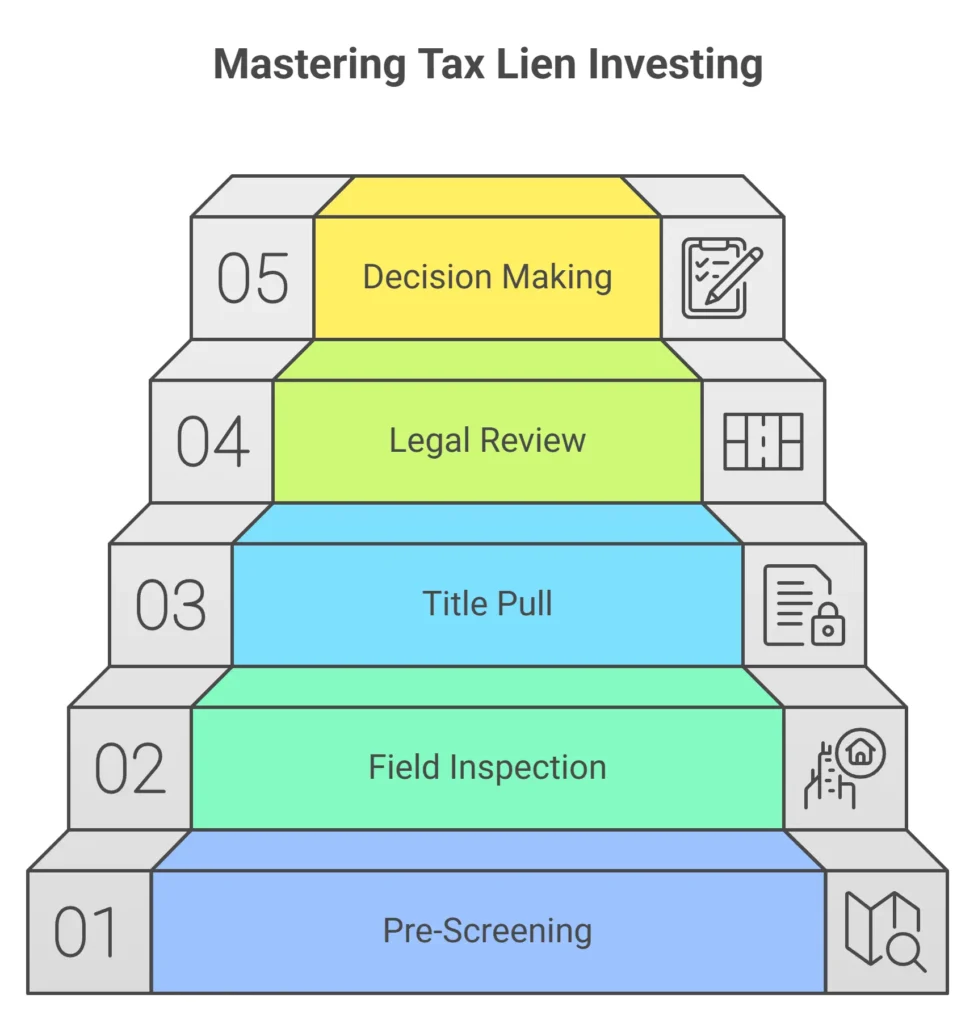

The Power of Advanced Due Diligence

Every investor knows to perform due diligence. But for tax lien and tax deed investing, this step isn’t just a formality—it’s the difference between a lucrative deal and a costly mistake.

Property Assessment: Go Beyond the Drive-By

A quick look from your car can tell you if a roof is caving in, but it won’t reveal a broken foundation, an environmental hazard, or a condemned building.

For properties you’re seriously considering, it’s worth physically inspecting the land.

Look for signs of significant damage, environmental concerns (e.g., from a former gas station), or other issues that could impact the after-repair value (ARV).

Title Search & Hidden Liens

You’ve heard that a tax lien has priority over most debts, but that’s not always the case. Some liens, such as a federal tax lien or certain environmental liens, can survive a tax deed sale.

That’s why a thorough title search is critical. Failing to identify these could leave you with a property and a hefty, unexpected debt.

Legal & Procedural Review

The most common way for a tax deed to be rendered invalid is a procedural error in the tax sale process. Did the county properly notify the property owner?

Was the auction conducted according to state law? You can’t assume everything was done correctly. A quick review with an attorney specializing in tax sales can save you from losing your investment.

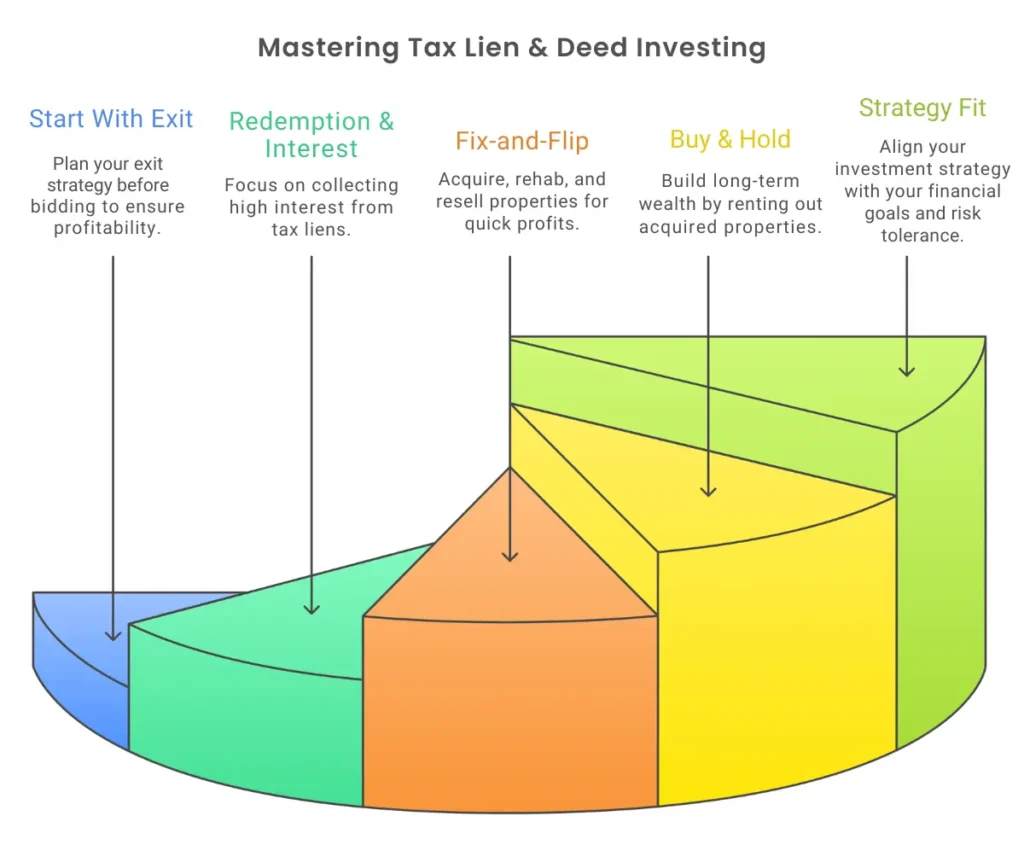

Exit Strategies: The Key to Unlocking Value

The beginner’s mindset is often focused on winning the auction. The pro’s mindset is focused on the exit. Before you bid a single dollar, you should already have a clear plan for how you’ll make a profit.

The Redemption & Interest Strategy (for Tax Liens)

For a tax lien investor, the primary goal is often not to acquire the property but to collect the high interest rate. This is a passive income strategy.

You should calculate the potential return based on the redemption period and the state-specific interest rates, making sure it aligns with your financial goals.

Fix-and-Flip (for Tax Deeds)

With a tax deed, you are acquiring the property. If you’re an active investor, a fix-and-flip strategy can be incredibly profitable.

But this requires a deep dive into calculating repair costs, the ARV, and the time and resources needed for a title cleanup. You’ll need to factor in everything from a new roof to a fresh coat of paint to a full kitchen remodel.

Buy and Hold

The strategy of acquiring a property via a tax deed and holding it as a rental can be very appealing. It’s a way to create a source of passive income and build long-term wealth.

This strategy, however, requires you to be prepared for the responsibilities of property management.

Navigating Legal and State-Specific Complexities

This is where the true challenge—and the greatest opportunity—lies. The legal framework for tax lien and tax deed investing varies dramatically from state to state. What works in Florida may be a disaster in Arizona.

Statutory Regulations

There is no federal tax lien code. You must fully understand the specific rules for your state, including the length of the redemption period, the maximum interest rate, and the legal process for initiating a foreclosure.

Bidding Strategies

It’s not just about winning the bid. States may have a “bid-up” method (common in tax deed states, where the highest bid wins) or a “bid-down” method (common in tax lien states, where the lowest interest rate wins).

Each has its own risks and rewards. Bidding too low on an interest rate can make your investment less profitable, while bidding too high on a property can erase your potential gains.

The Quiet Title Action

For tax deed properties, a “cloud” often remains on the title after the sale. This makes it difficult to secure a loan or sell the property to a conventional buyer.

A quiet title action is a lawsuit filed to resolve any lingering claims and “quiet” the title. This process is essential for making the property insurable and marketable.

FAQs

What is a "quiet title action" and why is it important?

A quiet title action is a lawsuit filed to resolve any lingering claims on a property's title. It's crucial for tax deed properties because it "clears" the title, making the property insurable and marketable for resale.

Can I lose money in tax lien investing?

Yes. The most common ways to lose money are by failing to follow the correct legal procedures, underestimating the costs of a potential foreclosure, or investing in a property with hidden issues. Due diligence is your best defense against these risks.

Conclusion

Is tax lien investing right for you?

Tax lien investing offers a unique opportunity for real estate professionals to diversify their portfolios and explore a strategy with high-yield potential. However, it is not a “get rich quick” scheme. The risks are real, and success depends on a meticulous, data-driven approach and a deep understanding of local laws.

For the savvy REP who is willing to do the necessary homework, tax lien & tax deed property property can become a valuable asset. The key is to start small, understand the legal landscape, and always prioritize due diligence over the promise of quick profits

Ready to take the next step in your tax lien investing journey? Reach out to us for more expert guides to get started.